Owens Corning Shakes Up Market: Exits Glass Reinforcements with Massive $755M Strategic Divestment

Business

2025-02-14 13:18:36Content

Owens Corning, a leading construction equipment manufacturer, announced on Friday a significant strategic move by agreeing to sell its glass reinforcements business to Praana Group, an India-based company. The transaction, valued at an impressive $755 million, marks a notable shift in the company's business portfolio.

The deal represents a strategic divestment for Owens Corning, potentially allowing the company to focus on its core competencies while providing Praana Group with an opportunity to expand its global footprint in the glass reinforcements market. Financial analysts suggest this transaction could bring substantial value to both organizations.

The sale is expected to be completed in the coming months, subject to customary closing conditions and regulatory approvals. Both Owens Corning and Praana Group have expressed confidence in the potential of this business transaction.

Global Manufacturing Titan Owens Corning Strikes Transformative $755 Million Deal with Indian Powerhouse

In a strategic move that underscores the dynamic landscape of international industrial partnerships, Owens Corning, a renowned construction equipment manufacturer, has announced a groundbreaking transaction that promises to reshape market dynamics and unlock unprecedented growth potential.A Landmark Transaction Redefining Global Manufacturing Strategies

Strategic Business Divestment: Unpacking the Glass Reinforcements Segment Sale

The recent announcement by Owens Corning reveals a meticulously planned divestment strategy targeting its glass reinforcements business. By selecting Praana Group, an India-based conglomerate, as the acquisition partner, the company demonstrates a nuanced approach to portfolio optimization. This transaction, valued at a substantial $755 million, represents more than a mere financial exchange—it symbolizes a calculated repositioning within the global manufacturing ecosystem. The strategic implications of this sale extend far beyond immediate monetary considerations. For Owens Corning, this move represents an opportunity to streamline operations, redirect resources towards core competencies, and potentially explore emerging market opportunities. The glass reinforcements segment, while historically significant, may have reached a maturation point that necessitates fresh strategic leadership.Praana Group's Ambitious Expansion: A Calculated Market Entry

For Praana Group, this acquisition represents a transformative moment in its corporate trajectory. By securing a high-value asset in the glass reinforcements sector, the Indian enterprise signals its intent to establish a more robust international footprint. The transaction provides immediate access to established manufacturing infrastructure, technological capabilities, and potentially valuable intellectual property. The strategic rationale behind Praana Group's investment suggests a long-term vision of vertical integration and technological advancement. By acquiring Owens Corning's glass reinforcements business, they are not merely purchasing an asset but investing in a comprehensive industrial ecosystem that promises significant future potential.Market Dynamics and Industrial Transformation

This transaction occurs against a backdrop of rapidly evolving global manufacturing landscapes. The construction and materials sectors are experiencing unprecedented technological disruption, with sustainability, efficiency, and innovation becoming critical differentiators. Owens Corning's decision to divest its glass reinforcements business can be interpreted as a proactive response to these emerging trends. The $755 million valuation reflects not just the current market value but also the anticipated future potential of the business. Both Owens Corning and Praana Group appear to have conducted extensive due diligence, ensuring that the transaction aligns with their respective strategic objectives. This level of meticulous planning underscores the sophisticated approach modern multinational corporations adopt when navigating complex business ecosystems.Technological and Economic Implications

Beyond the immediate financial transaction, this sale represents a fascinating case study in global industrial dynamics. It highlights the increasing interconnectedness of international markets, where companies seamlessly transcend geographical boundaries to pursue strategic opportunities. The transfer of a specialized manufacturing segment from a North American enterprise to an Indian conglomerate exemplifies the fluid nature of contemporary global commerce. The technological know-how embedded within the glass reinforcements business will likely undergo further refinement under Praana Group's stewardship. Such knowledge transfer can potentially catalyze innovation, creating a ripple effect that extends well beyond the immediate parties involved in the transaction.RELATED NEWS

Business

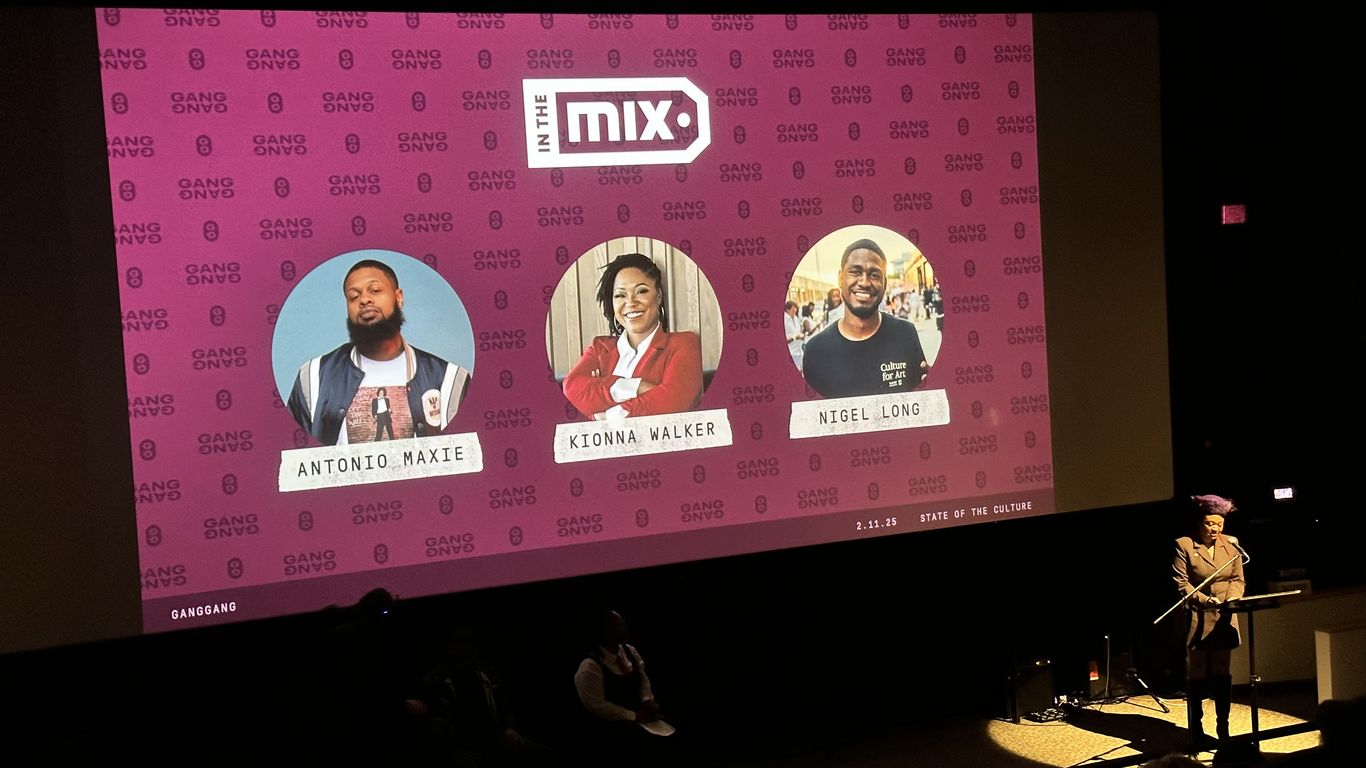

Breaking Barriers: How Indianapolis Is Redefining Black Entrepreneurship

2025-02-25 11:19:00

Business

Young Business Minds Shine: Local Students Earn Prestigious UIndy Scholarship

2025-02-28 18:42:00