Bitcoin Miners' January Rollercoaster: Profits, Challenges, and Crypto Resilience

Cryptocurrency

2025-02-14 15:09:55Content

Despite Bitcoin's impressive 9.6% price surge in January, cryptocurrency miners experienced an unexpected decline in production, revealing the complex dynamics of the digital mining landscape. The month's performance highlights the intricate relationship between market value and mining output, challenging simple assumptions about cryptocurrency economics.

While Bitcoin's price climbed, suggesting potential optimism in the market, mining production faced headwinds that prevented a corresponding increase in operational efficiency. This disconnect between price appreciation and production volume underscores the nuanced challenges facing Bitcoin miners in an increasingly competitive and volatile environment.

Factors such as energy costs, hardware performance, and network difficulty likely contributed to the production dip, demonstrating that miners must continuously adapt to rapidly changing market conditions. The January data serves as a reminder that cryptocurrency mining remains a sophisticated and unpredictable sector, where success depends on more than just market price movements.

Investors and industry observers are closely watching how miners will navigate these challenges, seeking strategies to maintain profitability in a landscape characterized by technological innovation and economic uncertainty.

Cryptocurrency Mining Dynamics: Unraveling the Bitcoin Production Paradox in January

In the ever-evolving landscape of digital currency, Bitcoin miners face unprecedented challenges that test the resilience of their operational strategies. The intricate interplay between market dynamics, technological infrastructure, and economic fluctuations continues to reshape the cryptocurrency mining ecosystem, presenting both opportunities and significant hurdles for industry participants.Decoding the Cryptic World of Bitcoin Mining Performance

Market Volatility and Production Challenges

The cryptocurrency mining sector experienced a complex narrative in January, characterized by a fascinating contradiction between market valuation and production output. Despite Bitcoin's impressive 9.6% price surge, miners encountered substantial operational constraints that impeded their production capabilities. This unexpected divergence highlights the multifaceted nature of cryptocurrency mining, where technological, economic, and infrastructural factors intersect in unpredictable ways. The underlying challenges stem from a combination of factors, including energy consumption patterns, hardware limitations, and increasingly competitive mining landscapes. Sophisticated mining operations must continuously adapt to rapidly changing technological and economic environments, balancing computational power with economic feasibility.Technological Infrastructure and Computational Complexity

Modern Bitcoin mining represents a sophisticated technological endeavor that extends far beyond simple computational processes. Advanced mining facilities require intricate cooling systems, robust electrical infrastructure, and cutting-edge hardware capable of handling increasingly complex cryptographic calculations. The January production dip underscores the delicate balance between technological capability and operational efficiency. Miners must navigate a complex ecosystem where marginal improvements in hardware efficiency can translate into significant competitive advantages. The continuous arms race of technological innovation demands substantial investments in research, development, and infrastructure upgrades.Economic Implications and Market Dynamics

The disconnect between Bitcoin's price appreciation and mining production reveals deeper economic complexities within the cryptocurrency ecosystem. Investors and industry analysts must look beyond surface-level metrics to understand the nuanced interactions between market valuation and operational output. Factors such as electricity costs, geopolitical regulations, and global economic trends play crucial roles in determining mining profitability. The January scenario demonstrates that price appreciation does not automatically correlate with increased production capacity, challenging traditional economic assumptions about cryptocurrency mining.Strategic Adaptations in Mining Operations

Successful mining organizations are increasingly adopting holistic strategies that transcend traditional operational models. This includes diversifying energy sources, implementing advanced cooling technologies, and developing more energy-efficient mining hardware. The ability to rapidly adapt to changing market conditions has become a critical competitive advantage. Miners who can quickly recalibrate their operational strategies in response to technological and economic shifts are more likely to maintain profitability and sustainability in this volatile landscape.Future Outlook and Technological Horizons

The cryptocurrency mining sector stands at a critical juncture, poised for potential transformative developments. Emerging technologies like quantum computing, advanced semiconductor designs, and innovative cooling mechanisms promise to revolutionize mining capabilities. Stakeholders must remain vigilant and adaptable, recognizing that the future of Bitcoin mining will be defined by those who can most effectively integrate technological innovation with strategic economic thinking. The January production dynamics serve as a compelling case study in the complex, ever-evolving world of cryptocurrency mining.RELATED NEWS

Cryptocurrency

NEAR Protocol's Rocky Road: Why This Crypto Darling Stumbled in 2025's Volatile Market

2025-02-24 10:50:12

Cryptocurrency

Crypto Showdown: Trump's Bold Vision to Crown America as the Global Blockchain Powerhouse

2025-03-07 14:30:08

Cryptocurrency

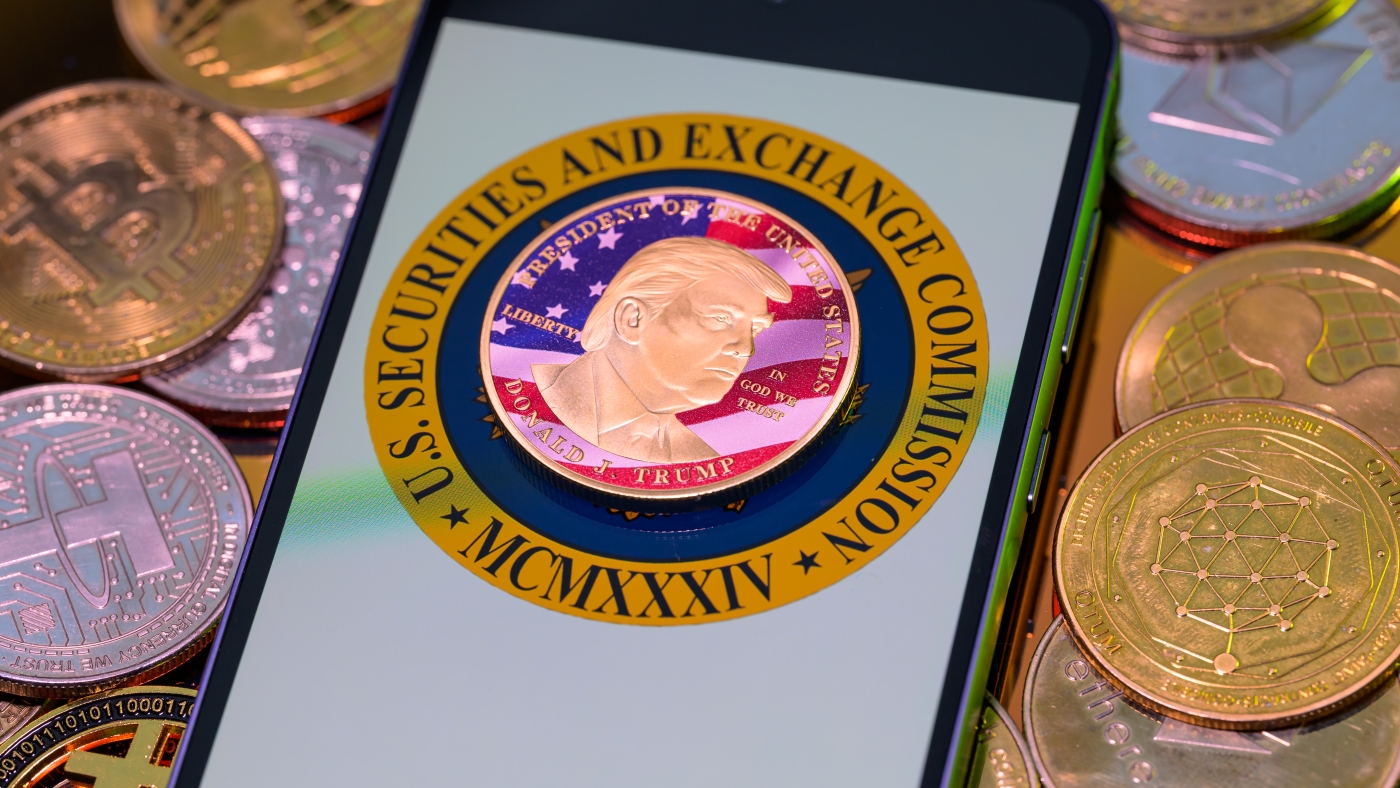

Crypto Clash: Coinbase Pushes for CFTC Takeover in Regulatory Showdown with SEC

2025-02-20 08:06:05