Korea's Crypto Frontier: Selective Access Sparks Corporate Investment Revolution

Cryptocurrency

2025-02-14 11:39:50Content

In a significant move towards cryptocurrency integration, Korea's Financial Services Commission (FSC) unveiled an innovative roadmap yesterday aimed at expanding corporate access to digital assets. Previously restricted from participating in cryptocurrency markets, corporations will now have new opportunities to engage with this emerging financial landscape.

The FSC's strategic plan represents a pivotal shift in the country's approach to digital currencies, signaling a more progressive stance towards blockchain and cryptocurrency technologies. By removing existing barriers, the commission hopes to foster greater financial innovation and provide corporations with additional investment and operational flexibility.

This landmark announcement is expected to inject new dynamism into Korea's financial ecosystem, potentially attracting more institutional interest in cryptocurrencies and supporting the broader digital asset infrastructure. The roadmap demonstrates Korea's commitment to staying at the forefront of financial technological advancement.

As details continue to emerge, businesses and financial experts are closely analyzing the potential implications of this groundbreaking policy shift. The move could potentially set a precedent for other countries considering similar regulatory approaches to corporate cryptocurrency engagement.

Korea's Crypto Frontier: A Groundbreaking Shift in Corporate Digital Asset Engagement

In the rapidly evolving landscape of digital finance, South Korea stands at the precipice of a transformative moment. The nation's financial regulatory bodies are poised to unleash unprecedented opportunities for corporate entities, signaling a monumental shift in the cryptocurrency ecosystem that could redefine traditional investment paradigms and economic strategies.Breaking Barriers: The Future of Corporate Cryptocurrency Participation

Regulatory Transformation and Strategic Vision

The Financial Services Commission's recent announcement represents a seismic shift in Korea's approach to digital assets. For years, corporations have been systematically excluded from direct cryptocurrency engagement, creating a restrictive environment that stifled innovation and limited financial flexibility. This groundbreaking roadmap signals a comprehensive reevaluation of existing regulatory frameworks, demonstrating Korea's commitment to becoming a global leader in blockchain and digital asset integration. The proposed changes are not merely incremental but represent a holistic reimagining of corporate financial strategies. By opening previously closed doors, Korean regulators are acknowledging the transformative potential of cryptocurrencies as legitimate financial instruments. This strategic pivot suggests a nuanced understanding of the global digital economy's evolving dynamics.Economic Implications and Technological Advancement

The potential impact of this regulatory transformation extends far beyond immediate financial considerations. Corporations will now have unprecedented opportunities to diversify investment portfolios, hedge against traditional market volatilities, and explore innovative financial technologies. This move positions Korean businesses at the forefront of global digital asset adoption, potentially attracting international investments and technological partnerships. Technological infrastructure will play a crucial role in this transition. Financial institutions and corporations will need to develop robust cybersecurity protocols, advanced blockchain integration mechanisms, and sophisticated risk management strategies. The implementation of these systems represents a significant technological leap, requiring substantial investments in human capital and technological resources.Global Context and Competitive Positioning

Korea's progressive stance contrasts sharply with more conservative regulatory environments worldwide. By creating a structured, transparent pathway for corporate cryptocurrency engagement, the nation is signaling its intent to become a global hub for digital financial innovation. This approach could potentially attract international technology firms, blockchain developers, and forward-thinking financial institutions seeking a supportive regulatory ecosystem. The strategic implications extend beyond immediate economic benefits. By embracing cryptocurrencies, Korea is positioning itself as a thought leader in the global digital transformation, challenging traditional financial paradigms and demonstrating remarkable adaptability in an increasingly complex global economic landscape.Challenges and Potential Risks

Despite the optimistic outlook, significant challenges remain. Cryptocurrency markets are notoriously volatile, and corporate engagement requires sophisticated risk management strategies. Regulatory frameworks must continuously evolve to address emerging technological complexities, cybersecurity threats, and potential market manipulations. Financial institutions and corporations will need to invest heavily in talent acquisition, technological infrastructure, and comprehensive training programs. The successful implementation of this roadmap will require a delicate balance between innovation and prudent risk management.Future Outlook and Potential Developments

As Korea charts this unprecedented path, the global financial community will be watching closely. The success of this initiative could potentially inspire similar regulatory approaches in other jurisdictions, fundamentally reshaping the relationship between traditional corporate structures and digital assets. The coming months and years will be critical in determining the long-term impact of this regulatory transformation. Corporations, technology experts, and financial analysts will be closely monitoring the implementation, potential challenges, and emerging opportunities presented by this groundbreaking approach.RELATED NEWS

Cryptocurrency

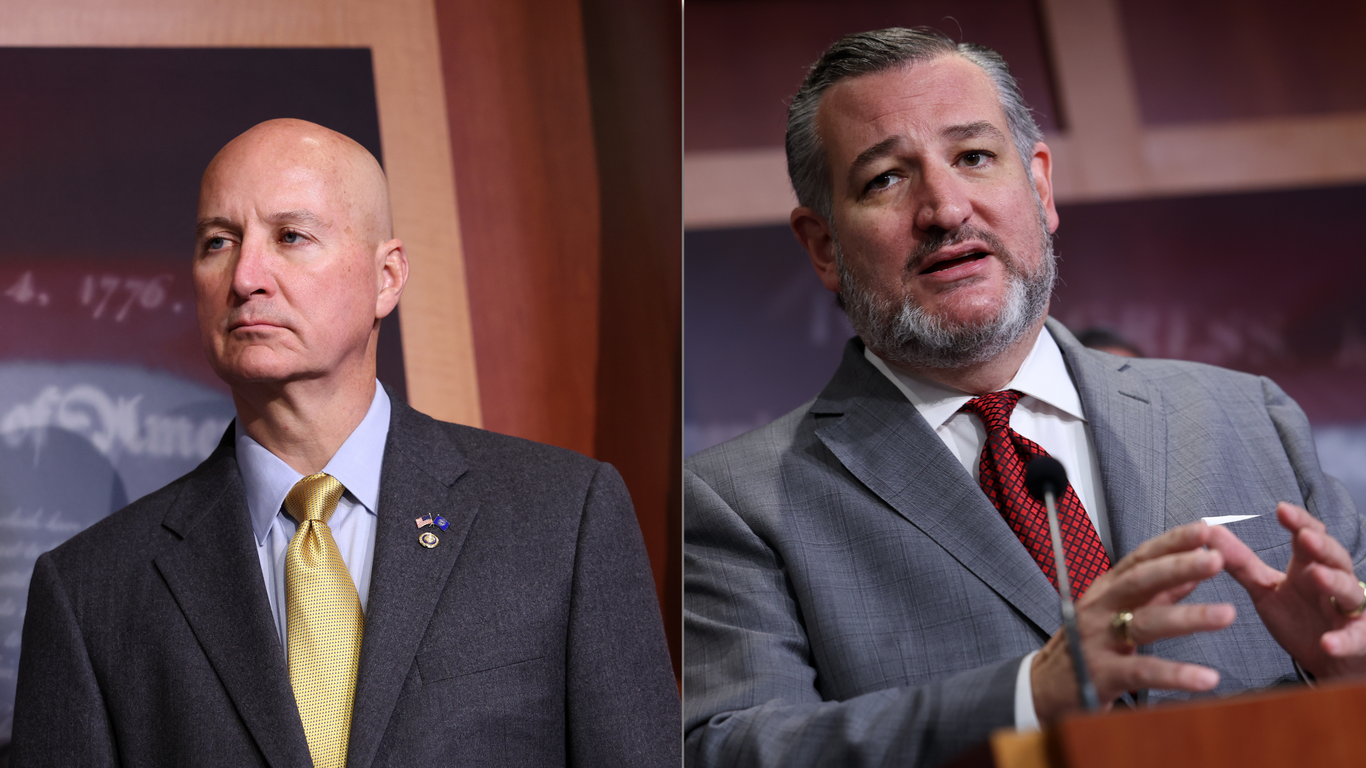

Crypto Crackdown Averted: Senate Strikes Down Controversial IRS Digital Asset Reporting Rule

2025-03-05 00:15:27

Cryptocurrency

Bitcoin as National Treasure: Trump Team Eyes Crypto as Strategic Financial Fortress

2025-03-07 16:53:54

Cryptocurrency

Wall Street's Crypto Crossroads: How Financial Giants Could Reshape Digital Assets

2025-03-04 09:17:09