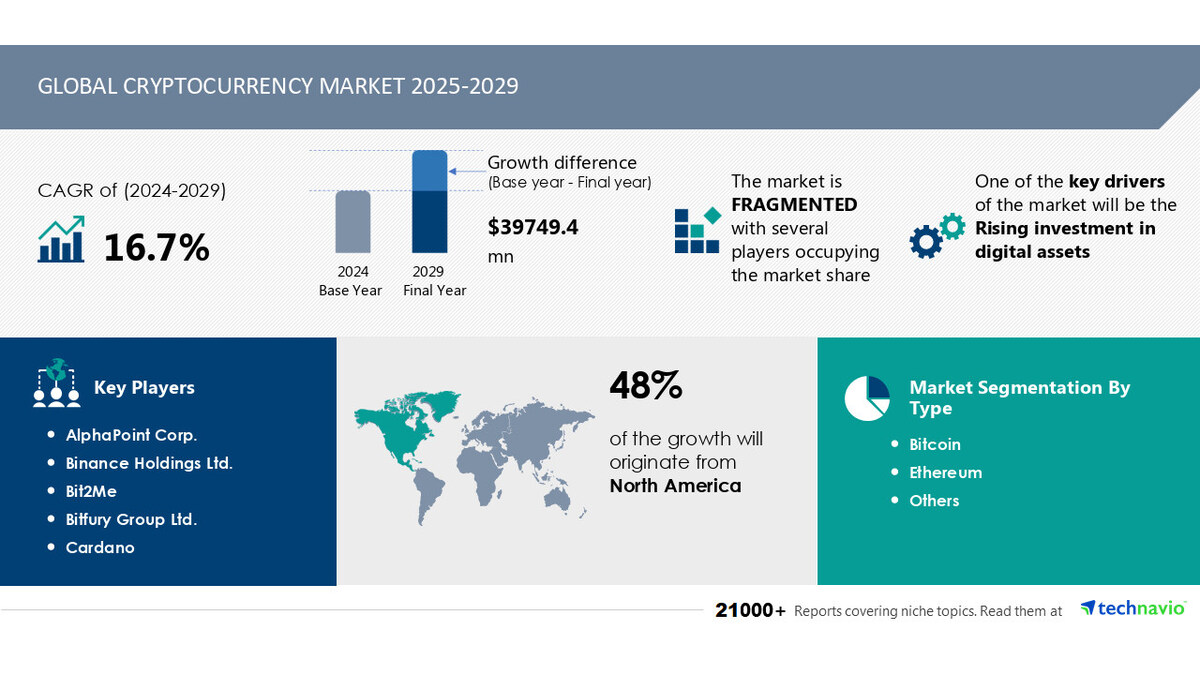

Crypto Revolution: AI Unleashes $39.75 Billion Market Explosion by 2029

Cryptocurrency

2025-02-15 03:34:00Content

Cryptocurrency Market Poised for Explosive Growth: AI-Powered Insights Reveal Massive Expansion

A groundbreaking market analysis powered by artificial intelligence predicts a remarkable surge in the global cryptocurrency market. Experts forecast an impressive growth of approximately USD 39.75 billion between 2025 and 2029, signaling a transformative period for digital financial technologies.

The comprehensive report highlights several key drivers behind this anticipated expansion, including:

- Increasing mainstream adoption of blockchain technologies

- Growing institutional investment in digital assets

- Enhanced regulatory frameworks supporting cryptocurrency ecosystems

- Technological innovations in decentralized finance (DeFi)

As traditional financial systems continue to evolve, cryptocurrencies are emerging as a pivotal force in the global economic landscape. The projected market growth reflects not just a trend, but a fundamental shift in how we perceive and interact with financial technologies.

Investors, technologists, and financial experts are closely watching this dynamic market, anticipating further breakthroughs and opportunities in the cryptocurrency sector.

Cryptocurrency Market Explosion: AI-Powered Insights Reveal Unprecedented Growth Trajectory

In the rapidly evolving landscape of digital finance, the cryptocurrency market stands at a critical juncture of technological innovation and economic transformation. As blockchain technologies continue to reshape global financial ecosystems, investors, technologists, and policymakers are witnessing an unprecedented surge of interest and investment in digital currencies that promise to redefine traditional monetary systems.Unleashing the Future: Cryptocurrency's Revolutionary Economic Potential

The Technological Revolution Driving Cryptocurrency Expansion

The cryptocurrency market is experiencing a profound metamorphosis, powered by cutting-edge artificial intelligence technologies that are fundamentally restructuring how digital assets are analyzed, traded, and understood. Advanced machine learning algorithms are now capable of predicting market trends with remarkable precision, enabling investors to navigate the complex and volatile cryptocurrency landscape with unprecedented strategic insight. Sophisticated neural networks are continuously processing massive datasets, identifying intricate patterns and potential investment opportunities that human analysts might overlook. These AI-driven systems are not merely observing market dynamics but actively reshaping investment strategies, risk management protocols, and predictive modeling in the cryptocurrency ecosystem.Global Market Dynamics and Economic Implications

Emerging economies are increasingly embracing cryptocurrency as a transformative financial instrument, challenging traditional banking infrastructures and offering alternative monetary solutions. The projected market expansion of USD 39.75 billion between 2025-2029 represents more than a numerical growth—it signifies a fundamental restructuring of global financial paradigms. Developing nations are particularly positioned to leverage cryptocurrency's decentralized nature, providing unprecedented financial access to populations traditionally excluded from conventional banking systems. Blockchain technologies are dismantling geographical and institutional barriers, creating unprecedented opportunities for economic democratization and financial inclusion.Technological Infrastructure and Investment Landscape

The cryptocurrency market's exponential growth is intrinsically linked to robust technological infrastructures that ensure security, transparency, and efficiency. Emerging blockchain protocols are developing increasingly sophisticated consensus mechanisms, addressing historical challenges of scalability, transaction speed, and energy consumption. Institutional investors are no longer viewing cryptocurrency as a speculative asset but as a legitimate and strategic component of diversified investment portfolios. Major financial institutions are developing specialized cryptocurrency divisions, signaling a profound shift in mainstream financial perspectives and acknowledging the sector's long-term potential.Regulatory Frameworks and Global Compliance

As cryptocurrency markets mature, comprehensive regulatory frameworks are emerging to provide structure, legitimacy, and investor protection. Governments worldwide are developing nuanced approaches that balance innovation with necessary oversight, recognizing cryptocurrency's potential to drive economic innovation while mitigating potential risks. International collaborations are creating standardized compliance protocols, enabling smoother cross-border transactions and reducing the historical fragmentation that has characterized cryptocurrency markets. These evolving regulatory landscapes are critical in transforming cryptocurrency from a niche technological experiment to a mainstream financial instrument.Future Outlook and Transformative Potential

The cryptocurrency market represents more than a financial trend—it embodies a fundamental reimagining of monetary systems in the digital age. As artificial intelligence continues to enhance predictive capabilities and blockchain technologies become increasingly sophisticated, we are witnessing the early stages of a profound economic revolution. Investors, technologists, and policymakers must remain adaptable, recognizing that the cryptocurrency landscape is characterized by continuous innovation, unexpected breakthroughs, and transformative potential that extends far beyond traditional financial paradigms.RELATED NEWS

Crypto Entrepreneur's Betrayal: San Francisco Businessman Convicted of Massive Investment Scam

Crypto Checkmate: Trump's Bold Plan to Revolutionize Digital Currency Reserves