Crypto Compass: Navigating the Digital Gold Rush of Modern Investments

Cryptocurrency

2025-02-11 12:00:00Content

Cryptocurrency Market Insights: Navigating the Digital Financial Frontier in 2025

In the dynamic world of digital finance, the cryptocurrency landscape continues to pulse with unprecedented energy and transformative potential. As we delve deeper into 2025, investors and blockchain enthusiasts find themselves at a critical juncture, seeking sophisticated strategies and razor-sharp insights to successfully navigate this complex and rapidly evolving market.

The cryptocurrency ecosystem has transcended its early experimental phase, emerging as a sophisticated financial domain that demands nuanced understanding and strategic thinking. Today's investors are no longer casual observers but strategic participants who recognize the intricate dynamics of digital assets.

Key trends are reshaping the cryptocurrency landscape, including:

- Enhanced regulatory frameworks

- Increased institutional adoption

- Advanced blockchain technologies

- Growing global market integration

Successful navigation requires a combination of deep market knowledge, technological awareness, and adaptive investment strategies. As the digital financial frontier continues to expand, those who remain informed and agile will be best positioned to capitalize on emerging opportunities.

Stay tuned for comprehensive analysis, expert perspectives, and actionable insights that will empower your cryptocurrency investment journey.

Crypto Revolution: Navigating the Digital Financial Frontier in 2025

In the rapidly transforming landscape of digital finance, cryptocurrency has emerged as a groundbreaking force reshaping traditional economic paradigms. Investors, technologists, and financial experts are witnessing an unprecedented era of technological innovation that challenges conventional understanding of monetary systems and investment strategies.Unlock the Future: Your Definitive Guide to Cryptocurrency Mastery

The Evolving Cryptocurrency Ecosystem

The cryptocurrency market has transcended its initial perception as a speculative investment vehicle. Today, it represents a sophisticated technological ecosystem driven by blockchain innovation, decentralized finance (DeFi), and complex algorithmic trading mechanisms. Sophisticated investors are no longer merely purchasing digital assets but strategically positioning themselves within a complex financial network that promises unprecedented transparency and autonomy. Blockchain technology continues to revolutionize multiple sectors beyond financial transactions. From supply chain management to healthcare data security, the underlying infrastructure of cryptocurrencies is creating transformative solutions that challenge traditional centralized systems. Developers and entrepreneurs are continuously exploring novel applications that extend far beyond simple monetary exchanges.Technological Advancements Driving Market Dynamics

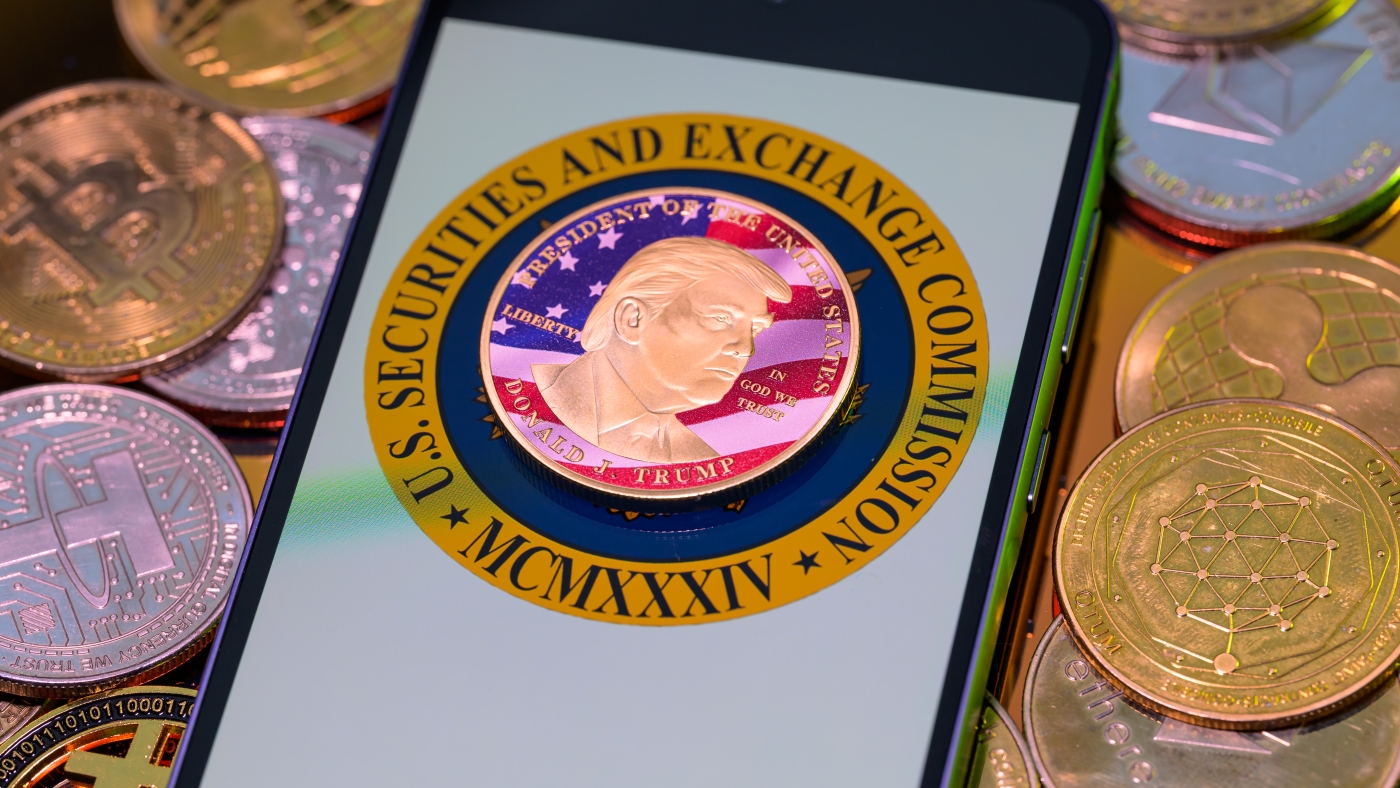

Emerging technologies like quantum computing and artificial intelligence are dramatically reshaping cryptocurrency infrastructure. Machine learning algorithms now predict market trends with remarkable accuracy, enabling investors to make more informed decisions. Advanced cryptographic techniques are simultaneously enhancing security protocols, addressing long-standing concerns about digital asset protection. The integration of smart contracts has fundamentally altered transactional processes. These self-executing contracts with embedded computational logic eliminate intermediaries, reducing transaction costs and increasing operational efficiency. Decentralized autonomous organizations (DAOs) are emerging as powerful alternatives to traditional corporate structures, offering unprecedented levels of transparency and collective decision-making.Global Regulatory Landscape and Economic Implications

Governments worldwide are developing nuanced regulatory frameworks to accommodate cryptocurrency's growing significance. While initial approaches were characterized by skepticism, many nations now recognize digital assets as legitimate financial instruments. Regulatory clarity is attracting institutional investors who previously remained on the sidelines. Economic analysts predict that cryptocurrencies will play an increasingly critical role in global financial systems. Developing economies are particularly positioned to benefit from decentralized financial technologies, potentially leapfrogging traditional banking infrastructure. Remittance markets, often burdened by high transaction fees, are being transformed by blockchain-based solutions that offer faster, more cost-effective money transfers.Investment Strategies for the Modern Digital Investor

Successful cryptocurrency investment requires a multifaceted approach combining technological understanding, market analysis, and risk management. Diversification remains crucial, with sophisticated investors spreading investments across multiple digital assets and blockchain projects. Advanced portfolio management tools now provide real-time analytics and predictive modeling, empowering investors to make data-driven decisions. Risk mitigation strategies have become increasingly sophisticated. Hedging techniques, options trading, and algorithmic trading platforms offer investors multiple layers of protection. The emergence of cryptocurrency derivatives and futures markets provides additional mechanisms for managing volatility and generating consistent returns.Emerging Trends and Future Projections

The next frontier of cryptocurrency development lies in seamless integration with traditional financial systems. Interoperability between blockchain networks and existing banking infrastructure is becoming increasingly sophisticated. Central bank digital currencies (CBDCs) represent a significant milestone, signaling mainstream acceptance of digital monetary technologies. Environmental sustainability is also gaining prominence within the cryptocurrency ecosystem. Next-generation blockchain networks are developing energy-efficient consensus mechanisms that dramatically reduce carbon footprints. Proof-of-stake algorithms and renewable energy-powered mining operations are addressing historical criticisms about cryptocurrency's environmental impact.RELATED NEWS

Bitcoin ETF Showdown: IBIT and FBTC Battle for Investor Supremacy

Mobile Mining Revolution: How Pi Network Is Rewriting Crypto's Playbook