Race to Riches: Crypto, Stocks, or NFTs—The 2025 Investment Showdown

Cryptocurrency

2025-02-11 08:15:14Content

As the new year dawned, the cryptocurrency world was buzzing with unprecedented excitement and high expectations. Many industry experts and investors anticipated 2023 would be a landmark year for digital currencies. However, the current market landscape tells a dramatically different story, with volatility shaking investor confidence and challenging previous optimistic predictions.

The crypto ecosystem has been thrown into a state of uncertainty, with dramatic price fluctuations and unpredictable market dynamics challenging even the most seasoned investors. What was once projected to be a breakthrough year now appears to be a complex and turbulent journey through uncharted financial territories.

Despite the current challenges, the underlying resilience of blockchain technology and digital assets continues to intrigue market watchers and financial innovators. The ongoing volatility serves as a stark reminder of the cryptocurrency market's inherent unpredictability and the need for cautious, strategic investment approaches.

Crypto's Rollercoaster Ride: Navigating the Turbulent Waters of Digital Finance in 2024

The cryptocurrency landscape continues to challenge even the most seasoned investors and analysts, presenting a complex narrative of innovation, volatility, and unprecedented market dynamics that demand careful examination and strategic insight.Decoding the Cryptocurrency Conundrum: Survival Strategies in an Unpredictable Market

The Shifting Paradigm of Digital Currency Investments

The cryptocurrency ecosystem has transformed dramatically, evolving from a niche technological experiment to a global financial phenomenon that challenges traditional economic frameworks. Investors and market analysts are witnessing an unprecedented period of transformation, where digital assets demonstrate remarkable resilience despite extreme market fluctuations. The current landscape reveals a nuanced interplay between technological innovation, regulatory pressures, and investor sentiment that creates a complex and dynamic investment environment. Institutional involvement has significantly reshaped the cryptocurrency marketplace, introducing sophisticated investment strategies and increased legitimacy. Major financial institutions are no longer viewing digital currencies as speculative assets but as legitimate financial instruments with substantial potential for portfolio diversification and long-term value generation.Technological Foundations and Market Resilience

Blockchain technology continues to serve as the fundamental infrastructure driving cryptocurrency's evolution, offering unprecedented transparency, security, and decentralization. The underlying technological framework has demonstrated remarkable adaptability, enabling cryptocurrencies to withstand significant market pressures and maintain their fundamental value proposition. Emerging cryptographic innovations are creating more robust and scalable blockchain networks, addressing previous limitations related to transaction speed, energy consumption, and overall efficiency. These technological advancements are critical in maintaining investor confidence and attracting mainstream financial participation.Regulatory Landscapes and Global Perspectives

Global regulatory environments are experiencing profound transformations, with governments worldwide developing more sophisticated approaches to cryptocurrency governance. Regulatory frameworks are becoming increasingly nuanced, balancing consumer protection with technological innovation and economic opportunity. Different jurisdictions are adopting varied strategies, ranging from strict regulatory control to more progressive, innovation-friendly approaches. This diverse regulatory landscape creates unique challenges and opportunities for cryptocurrency investors and blockchain entrepreneurs, requiring adaptive strategies and comprehensive market understanding.Investment Strategies in a Volatile Market

Successful cryptocurrency investment demands a multifaceted approach that combines rigorous research, risk management, and strategic diversification. Experienced investors are developing sophisticated methodologies that go beyond traditional investment paradigms, leveraging advanced analytical tools and comprehensive market intelligence. Risk mitigation strategies have become increasingly sophisticated, incorporating advanced hedging techniques, algorithmic trading models, and comprehensive portfolio management approaches. The most successful investors demonstrate an ability to navigate market volatility with calculated precision and strategic foresight.Future Projections and Emerging Trends

The cryptocurrency ecosystem is poised for continued evolution, with emerging trends suggesting increased institutional integration, technological innovation, and mainstream adoption. Decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and advanced blockchain applications are expected to play increasingly significant roles in reshaping financial ecosystems. Artificial intelligence and machine learning technologies are likely to introduce more sophisticated trading algorithms and predictive models, further professionalizing the cryptocurrency investment landscape. These technological advancements promise to enhance market efficiency, transparency, and accessibility.RELATED NEWS

Cryptocurrency

Crypto Crackdown Crushed: Senate Strikes Down Biden-Era Tax Reporting Mandate

2025-03-05 11:46:09

Cryptocurrency

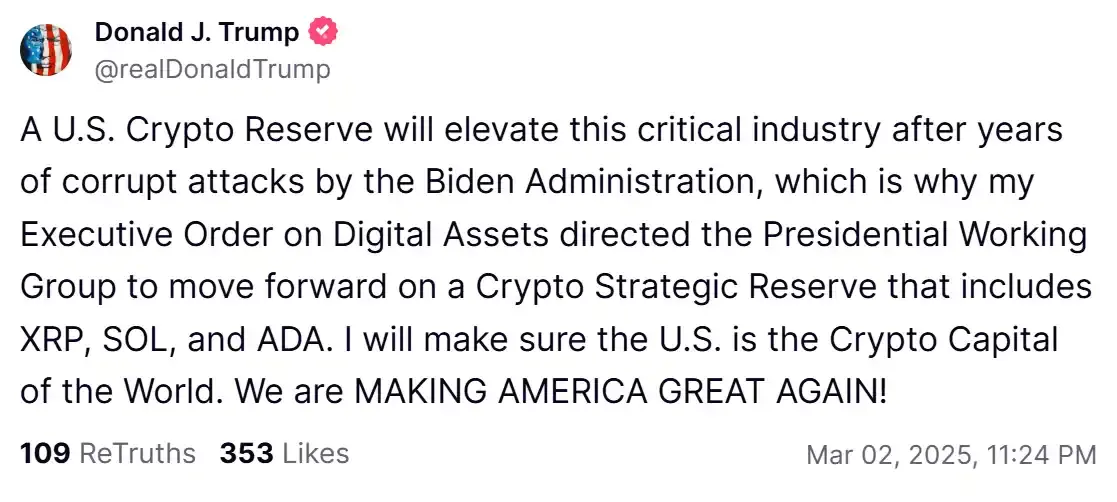

Breaking: Trump Mobilizes Presidential Task Force to Strategize Crypto Reserves, Spotlights XRP, SOL, and ADA

2025-03-02 14:31:00

Cryptocurrency

Bitcoin Goes Lone Star: Texas Senate Blazes Trail with Groundbreaking Digital Asset Reserve Bill

2025-03-06 18:48:06