Pokémon Go's Saudi Surprise: Tech Giant Mulls Massive Gaming Sell-Off

Technology

2025-02-19 15:18:19Content

Niantic, the renowned developer behind the wildly popular augmented reality game Pokémon Go, is reportedly exploring a potential sale of its gaming business for approximately $3.5 billion. According to Bloomberg's financial news report, the company is in advanced negotiations with Scopely, a mobile gaming powerhouse backed by the Saudi Arabian sovereign wealth fund.

The potential multi-billion dollar transaction could mark a significant shift in the mobile gaming landscape, with Scopely emerging as a potential new owner of the innovative game studio responsible for Pokémon Go's global success. Sources close to the negotiations suggest that the deal is currently in progress and could reshape the company's future strategic direction.

While details remain preliminary, the potential sale highlights the continued investment interest in mobile gaming platforms and the substantial valuation of successful gaming enterprises. Niantic has been known for creating groundbreaking augmented reality experiences that blend digital gameplay with real-world exploration.

As negotiations continue, industry observers are closely watching the potential transaction, which could have far-reaching implications for both Niantic and the mobile gaming ecosystem.

Gaming Giant Niantic Poised for Massive Acquisition in Mobile Entertainment Landscape

In the rapidly evolving world of mobile gaming, a potential groundbreaking transaction is emerging that could reshape the digital entertainment ecosystem. The imminent sale of a pioneering game development company signals a significant shift in the global interactive entertainment market, capturing the attention of industry analysts and gaming enthusiasts worldwide.Transformative Deal Set to Redefine Mobile Gaming Dynamics

Strategic Negotiations and Market Implications

The mobile gaming industry stands on the precipice of a transformative moment as Niantic, the renowned developer behind augmented reality sensations, enters advanced discussions for a potential multi-billion dollar divestment. Sources close to the negotiations reveal that the company is exploring a strategic sale that could fundamentally alter its corporate trajectory. The prospective transaction, valued approximately at $3.5 billion, represents more than a mere financial exchange but potentially signals a broader realignment of technological and entertainment assets. Scopely, a prominent mobile game production company backed by the Saudi Arabian sovereign wealth fund, emerges as the primary contender in these high-stakes negotiations. This potential acquisition transcends traditional business transactions, representing a complex interplay of technological innovation, strategic investment, and global entertainment market dynamics.Technological Innovation and Market Positioning

Niantic's portfolio, most notably exemplified by the globally acclaimed "Pokémon Go", represents a unique intersection of augmented reality, location-based gaming, and interactive entertainment. The potential sale underscores the increasing valuation of innovative gaming platforms that successfully merge digital experiences with real-world engagement. The involvement of the Saudi Arabian sovereign wealth fund through Scopely highlights the growing interest of international investment entities in the digital entertainment sector. This strategic move reflects a broader trend of diversification and technological investment beyond traditional economic boundaries.Industry Landscape and Future Projections

The potential acquisition signals a significant moment in the mobile gaming ecosystem. Niantic's technological prowess, combined with Scopely's robust financial backing, could create a formidable entity capable of driving unprecedented innovation in interactive digital experiences. Market analysts suggest that this transaction could trigger a cascade of strategic realignments within the mobile gaming industry. The substantial valuation of $3.5 billion underscores the immense economic potential of innovative gaming platforms that successfully integrate cutting-edge technology with engaging user experiences.Global Investment and Technological Convergence

The potential sale represents more than a mere corporate transaction. It symbolizes the increasing convergence of technology, entertainment, and global investment strategies. The involvement of international investment entities like the Saudi Arabian sovereign wealth fund demonstrates the growing recognition of digital platforms as critical assets in the modern economic landscape. This potential acquisition could potentially accelerate technological innovation, create new employment opportunities, and further solidify the mobile gaming industry's position as a dynamic and lucrative sector of the global digital economy.RELATED NEWS

Technology

Apple's AI Revolution: Siri's Smarter Upgrade Delayed, Fans Left Waiting

2025-02-14 22:16:57

Technology

Unfold the Future: Huawei's Groundbreaking $3,000 Tri-Fold Smartphone Lands in Malaysia

2025-02-18 07:00:21

Technology

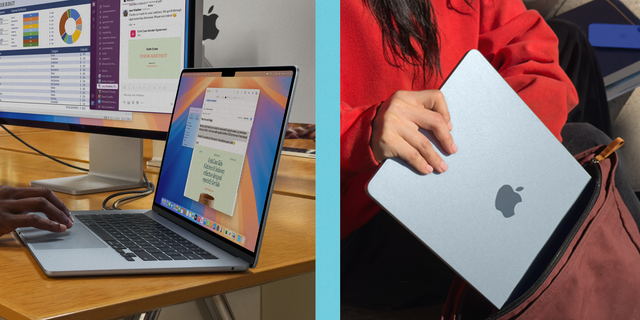

Sleek, Powerful, Revolutionary: Apple's Latest MacBook Air Drops Jaws

2025-03-05 17:01:00