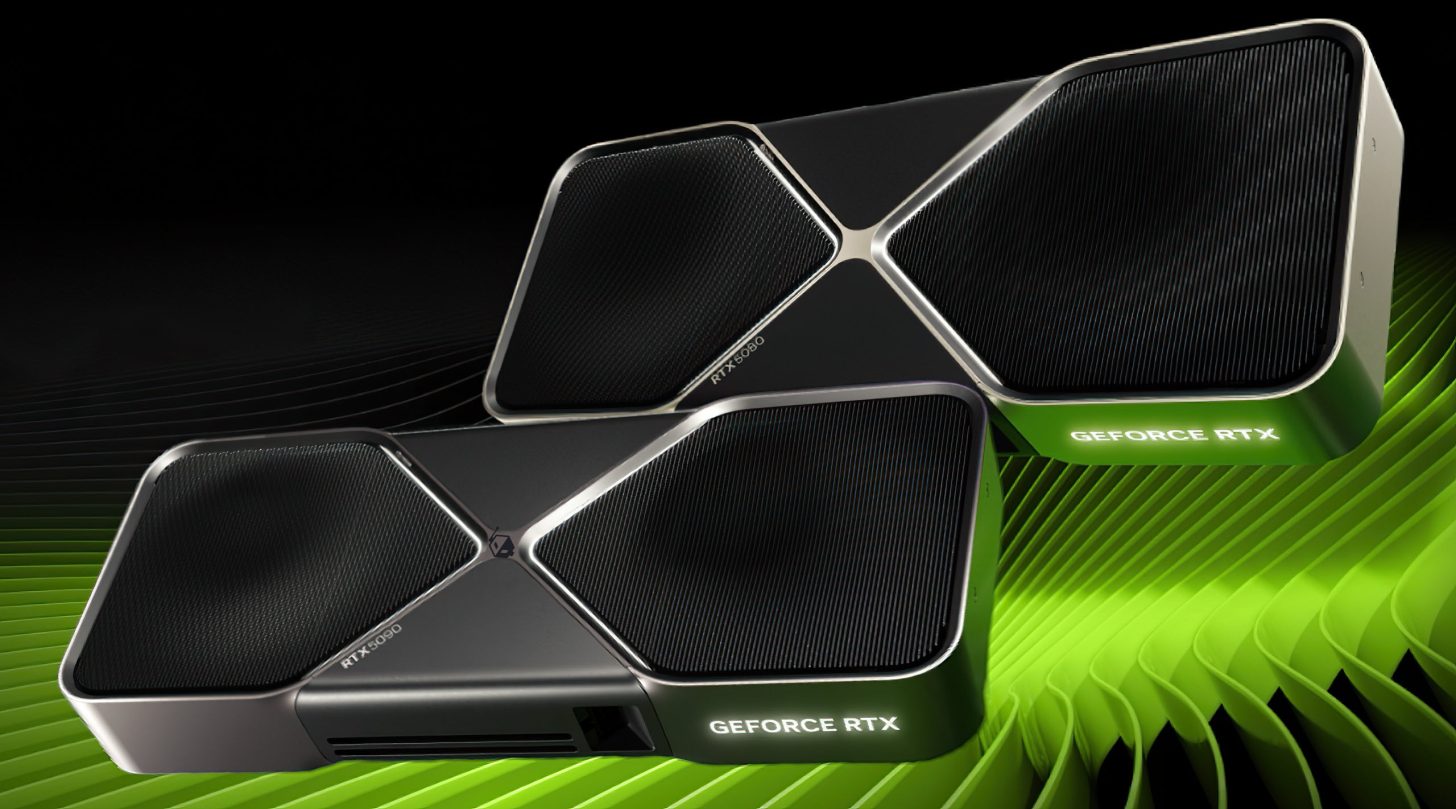

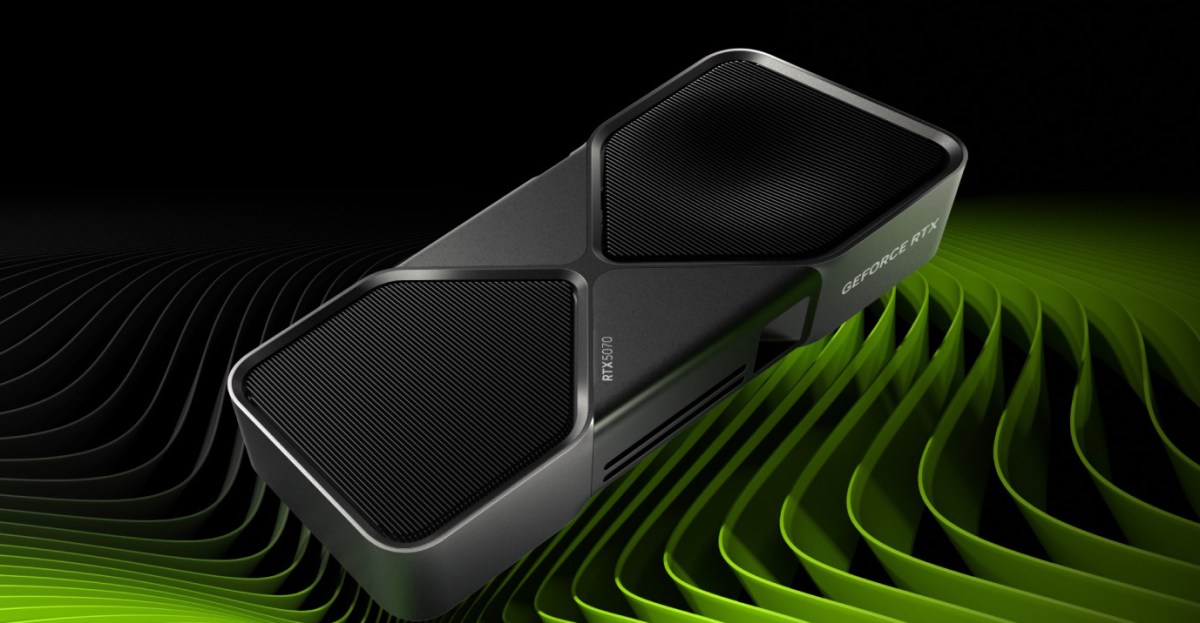

GPU Hunt: Nvidia's RTX 5070 Ti Drops - Your Ultimate Buying Guide Revealed!

Technology

2025-02-19 14:26:58Content

In the dynamic world of investing, one question constantly echoes through the minds of both novice and seasoned investors: Should I stock up on investments, or play it safe?

The art of stock investing is far more nuanced than simply throwing money at the market. It's a delicate dance of strategy, research, and calculated risk. Every potential investor faces a crossroads where careful consideration meets opportunity.

Understanding your financial goals is the first critical step. Are you seeking short-term gains or long-term wealth accumulation? Your investment strategy should align perfectly with your personal financial blueprint. Some investors thrive on the adrenaline of active trading, while others prefer the steady, predictable growth of diversified portfolios.

Risk tolerance plays a pivotal role in this decision. Not everyone is comfortable watching market fluctuations like a roller coaster ride. Some prefer the stability of blue-chip stocks, while others are willing to explore more volatile but potentially lucrative emerging market opportunities.

Diversification isn't just a buzzword—it's your financial safety net. Spreading investments across different sectors and asset classes can help mitigate potential losses and create a more robust investment strategy.

Remember, successful investing isn't about timing the market perfectly, but about time in the market. Patience, research, and a clear understanding of your financial objectives are the true keys to investment success.

Navigating the Investment Landscape: A Comprehensive Guide to Strategic Portfolio Management

In the ever-evolving world of financial markets, investors face a critical crossroads of decision-making that can dramatically impact their long-term wealth and financial security. The art of investment is not merely about choosing stocks or assets, but understanding the intricate dance of market dynamics, risk management, and strategic positioning that separates successful investors from those who merely hope for financial prosperity.Unlock Your Financial Potential: Master the Science of Smart Investing

The Psychology of Investment Decision-Making

Financial experts have long recognized that investment is as much an emotional journey as it is a mathematical calculation. The human mind plays a crucial role in determining investment success, with cognitive biases often leading investors astray. Psychological barriers such as fear, greed, and overconfidence can create significant obstacles in rational decision-making. Successful investors develop a disciplined approach that transcends emotional impulses. They understand that market volatility is an inherent characteristic of financial systems, requiring a calm and strategic mindset. By cultivating emotional intelligence and implementing robust decision-making frameworks, investors can navigate the complex terrain of financial markets with greater precision and confidence.Diversification: The Cornerstone of Intelligent Investment Strategies

Diversification represents more than a simple risk mitigation technique; it is a fundamental philosophy of intelligent investment management. Modern portfolio theory suggests that spreading investments across multiple asset classes, sectors, and geographical regions can significantly reduce overall portfolio risk while maintaining potential for growth. The art of diversification extends beyond traditional asset allocation. Sophisticated investors explore alternative investment vehicles, including emerging markets, technology-driven opportunities, and innovative financial instruments. By creating a multi-layered investment approach, individuals can build resilient portfolios that can withstand market fluctuations and capitalize on diverse economic opportunities.Technological Disruption and Investment Opportunities

The rapid acceleration of technological innovation has fundamentally transformed the investment landscape. Artificial intelligence, blockchain technology, and data analytics have introduced unprecedented opportunities for sophisticated investors to gain competitive advantages. Emerging technologies provide investors with real-time market insights, predictive analytics, and advanced risk assessment tools. Machine learning algorithms can process vast amounts of financial data, identifying patterns and potential investment opportunities that traditional analysis might overlook. By embracing these technological advancements, investors can develop more nuanced and dynamic investment strategies.Risk Management in a Complex Global Economy

Contemporary investment strategies require a holistic approach to risk management that considers global economic interconnectedness. Geopolitical tensions, environmental challenges, and rapidly changing economic paradigms demand a more comprehensive understanding of potential risks. Sophisticated risk management involves continuous monitoring of macroeconomic trends, geopolitical developments, and sector-specific dynamics. Investors must develop adaptive strategies that can quickly respond to changing market conditions, utilizing advanced hedging techniques and flexible asset allocation models.The Future of Personal Investment Strategies

The democratization of financial information and investment tools has transformed the investment landscape. Individual investors now have access to sophisticated resources that were once exclusive to institutional investors. Online platforms, educational resources, and advanced trading technologies have leveled the playing field. However, this accessibility also demands greater financial literacy and personal responsibility. Successful investors must continuously educate themselves, stay informed about market trends, and develop a nuanced understanding of complex financial ecosystems.RELATED NEWS

Technology

Graphics Powerhouse Incoming: Nvidia's Mid-Range RTX 5070 Set to Shake Up the GPU Market

2025-02-13 20:57:19

Technology

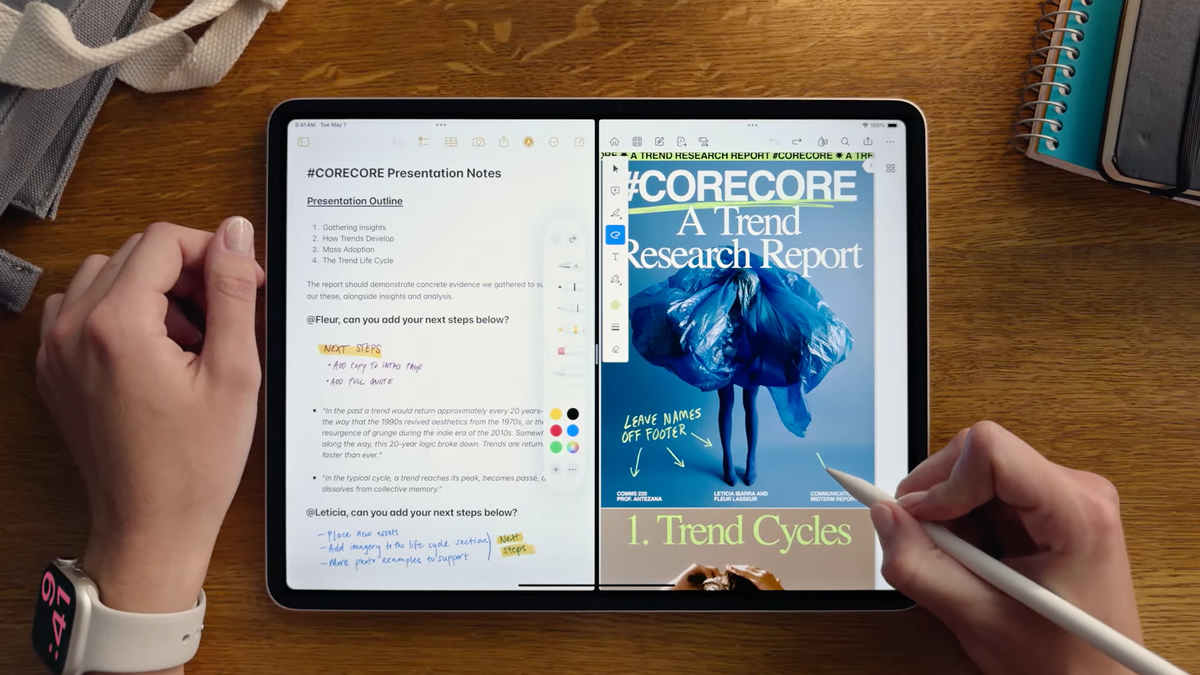

Apple's Next Big Move: iPad Pro Poised to Follow M4 MacBook Air's Groundbreaking Launch

2025-03-03 13:00:15