The Silent Budget Killer: When Your Raise Becomes a Spending Trap

Lifestyle

2025-02-11 15:53:32Content

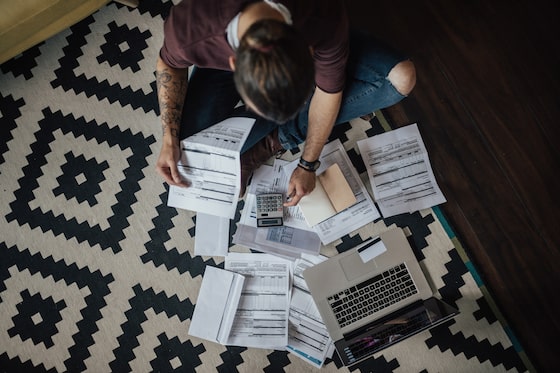

Financial experts warn that the seemingly insignificant decisions we make today can silently erode our financial stability, potentially creating substantial challenges for our future financial well-being. What might appear as minor, inconsequential choices can gradually accumulate, undermining our economic resilience and long-term financial security.

Small daily habits like impulse purchases, neglecting savings, or consistently overspending can create subtle but persistent financial vulnerabilities. These incremental choices might not feel impactful in the moment, but they can ultimately compromise our ability to withstand unexpected economic challenges or pursue meaningful financial goals.

By recognizing the cumulative power of our everyday financial decisions, we can proactively make more intentional choices that strengthen our economic foundation and protect our financial future. Awareness and mindful decision-making are key to maintaining robust financial health and building lasting economic resilience.

Financial Pitfalls: The Silent Erosion of Your Economic Stability

In the intricate landscape of personal finance, seemingly innocuous decisions can gradually undermine your economic foundation, creating vulnerabilities that may not become apparent until critical moments of financial stress emerge. The journey of financial resilience is paved with nuanced choices that demand strategic thinking and proactive management.Unmasking the Hidden Threats to Your Financial Future

The Psychological Mechanics of Financial Decision-Making

Modern economic psychology reveals that human beings are remarkably complex when it comes to financial choices. Our decisions are rarely purely rational, often influenced by deep-seated emotional triggers, cognitive biases, and unconscious patterns learned through familial and societal experiences. These psychological undercurrents can lead individuals to make incremental choices that appear harmless in the moment but accumulate into significant financial vulnerabilities over time. Financial experts have long observed that most people underestimate the compounding effect of small, repeated behaviors. What might seem like a minor monthly expense or an insignificant spending habit can transform into a substantial economic drain when analyzed through a long-term lens. The human brain is particularly susceptible to present-moment gratification, often discounting future consequences.Micro-Decisions: The Silent Economic Disruptors

Every financial transaction carries potential long-term implications that extend far beyond immediate gratification. Recurring subscriptions, impulse purchases, and lifestyle inflation represent subtle mechanisms that can gradually erode economic stability. These micro-decisions create intricate webs of financial complexity that can trap individuals in cycles of economic vulnerability. Consider the seemingly harmless practice of dining out frequently or maintaining multiple streaming service subscriptions. While individually these expenses might appear negligible, their cumulative impact can represent thousands of dollars annually that could have been strategically invested or saved. The opportunity cost of such decisions represents a critical yet often overlooked dimension of personal financial management.Strategic Resilience: Constructing Economic Safeguards

Building genuine financial resilience requires a multifaceted approach that transcends traditional budgeting methodologies. It demands a holistic understanding of personal economic ecosystems, incorporating psychological awareness, strategic planning, and continuous self-assessment. Developing robust financial safeguards involves creating multiple layers of protection. This includes establishing emergency funds, diversifying income streams, continuously upgrading professional skills, and maintaining adaptable investment portfolios. The goal is not merely to accumulate wealth but to construct a dynamic economic infrastructure capable of withstanding unexpected challenges.Technology and Financial Consciousness

Emerging technological platforms are revolutionizing how individuals track, understand, and optimize their financial behaviors. Advanced analytics, artificial intelligence-driven insights, and personalized financial coaching tools are empowering consumers to make more informed decisions. These technological interventions provide unprecedented transparency, allowing individuals to visualize the long-term consequences of their current financial choices. By transforming abstract financial concepts into tangible, comprehensible data visualizations, these platforms bridge the gap between intention and execution in personal economic management.Cultural and Systemic Influences on Financial Behavior

Financial decision-making cannot be understood in isolation from broader cultural and systemic contexts. Societal narratives, educational backgrounds, and economic environments profoundly shape individual financial consciousness. Recognizing these external influences becomes crucial in developing more nuanced, self-aware approaches to economic management. The interplay between personal agency and systemic constraints creates a complex landscape where financial resilience is continuously negotiated. Understanding these dynamics allows individuals to develop more sophisticated strategies that account for both personal capabilities and broader economic realities.RELATED NEWS

Lifestyle

Behind the Fairway Fame: Anna Canter - The Woman Shaping a Pro Golfer's World

2025-03-02 12:53:27

Lifestyle

Splurge Alert: Millennials and Gen Z Reveal Top Spending Habits in Surprising Study

2025-02-19 02:43:13

Lifestyle

Breaking: How One Simple Shift Transforms Your Entire Approach to Health Forever

2025-02-19 06:00:00