Crypto Rollercoaster: Bitcoin's Sharp Tumble Wipes Out Trump-Era Gains

Cryptocurrency

2025-02-25 15:59:49Content

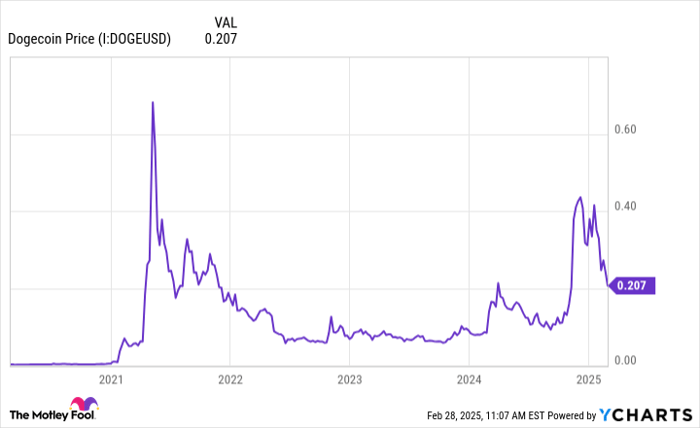

Cryptocurrency markets experienced a sharp downturn on Tuesday morning, with Bitcoin plummeting below the $90,000 mark and other digital assets suffering significant losses. The sudden decline has effectively wiped out recent gains that cryptocurrencies had accumulated since the onset of the pro-crypto political landscape.

Investors and market watchers were caught off guard by the rapid sell-off, which erased substantial value from the digital asset ecosystem. The dramatic drop comes as a stark reminder of the volatile nature of cryptocurrency markets, challenging the optimistic momentum that had been building in recent months.

The unexpected market correction highlights the ongoing uncertainty and sensitivity of digital currencies to political and economic shifts, underscoring the need for cautious investment strategies in this dynamic financial landscape.

Crypto Market Tremors: Bitcoin's Dramatic Plunge Signals Volatile Digital Asset Landscape

In the ever-shifting world of digital currencies, investors and market watchers find themselves once again navigating the turbulent waters of cryptocurrency volatility. The recent dramatic downturn in Bitcoin's value and the broader crypto market has sent shockwaves through the financial ecosystem, challenging the optimistic narratives that have dominated recent discussions.Cryptocurrency Markets: When Optimism Meets Harsh Economic Realities

The Unexpected Market Correction

The cryptocurrency landscape experienced a seismic shift as Bitcoin's value dramatically plummeted below the psychologically significant $90,000 threshold. This sudden downturn represents more than just a numerical decline; it symbolizes the fragile nature of digital asset valuations. Investors who had been riding the wave of optimism, particularly those inspired by recent political rhetoric surrounding crypto-friendly policies, found themselves confronting a stark market reality. The correction wasn't isolated to Bitcoin alone. Multiple cryptocurrencies experienced substantial drops, creating a domino effect that reverberated across digital asset portfolios. Traders and long-term investors alike watched in real-time as gains accumulated over months evaporated within hours, underscoring the inherent volatility of the cryptocurrency market.Political Promises vs. Market Dynamics

The recent market movement comes in the wake of political promises that had previously buoyed crypto investor sentiment. The previous administration's seemingly pro-cryptocurrency stance had generated significant excitement and speculative investment. However, this latest market correction demonstrates that political rhetoric cannot insulate digital assets from fundamental economic pressures. Cryptocurrency experts suggest that this downturn is part of a broader market recalibration. The dramatic price fluctuations reflect complex interactions between global economic conditions, regulatory environments, and investor sentiment. Unlike traditional financial markets, cryptocurrencies remain uniquely susceptible to rapid sentiment shifts and technological developments.Technological and Regulatory Implications

Beyond immediate price concerns, this market movement raises critical questions about the long-term stability of cryptocurrencies. Regulatory bodies worldwide continue to scrutinize digital assets, with each market correction potentially influencing future legislative approaches. The current downturn might prompt increased calls for more robust oversight and consumer protection mechanisms. Blockchain technology underlying these cryptocurrencies continues to evolve, potentially offering more stable frameworks for digital asset transactions. However, the current market volatility suggests that technological innovation alone cannot guarantee market stability. Investors must remain vigilant, understanding that the cryptocurrency landscape remains fundamentally unpredictable.Global Economic Context

The cryptocurrency market's recent performance cannot be viewed in isolation. Global economic indicators, including inflation rates, geopolitical tensions, and monetary policies, play significant roles in shaping digital asset valuations. The current market correction might be interpreted as a reflection of broader economic uncertainties rather than a cryptocurrency-specific phenomenon. Institutional investors and individual traders alike are recalibrating their strategies in response to these market dynamics. The ability to adapt quickly and maintain a diversified investment approach becomes increasingly crucial in navigating the complex world of digital assets.Future Outlook and Investor Strategies

While the current market correction might seem alarming, seasoned cryptocurrency observers emphasize the importance of maintaining a long-term perspective. Historical data suggests that such volatility is not unprecedented in the digital asset ecosystem. Successful investors often view these moments as opportunities for strategic repositioning rather than reasons for panic. Risk management strategies, including portfolio diversification and measured investment approaches, become paramount in such uncertain market conditions. The cryptocurrency landscape continues to represent both significant opportunities and substantial challenges for those willing to engage with this emerging financial frontier.RELATED NEWS

Cryptocurrency

Crypto Crossroads: The $1,000 Investment Trap Meme Coins Don't Want You to Know

2025-03-03 12:30:00

Cryptocurrency

From BTC Mastermind to Moscow: Crypto Kingpin Alexander Vinnik's Dramatic Return

2025-02-14 07:34:17