Crypto Bloodbath: Bitcoin Braces for Steep 11.7% Weekly Plunge as Market Sentiment Turns Bearish

Cryptocurrency

2025-02-28 19:15:08Content

Bitcoin Braces for Significant Weekly Decline Amid Global Economic Tensions

The cryptocurrency market is experiencing turbulent waters as Bitcoin faces a potential 11.7% weekly downturn. Investors are growing increasingly cautious, rapidly offloading risky assets in response to mounting economic uncertainties and the specter of impending trade tariffs.

Market sentiment has turned notably bearish, with traders and investors seeking safer havens amid the growing volatility. The anticipated price drop reflects broader market apprehensions about geopolitical and economic challenges that are currently reshaping investment strategies across multiple asset classes.

As global economic pressures intensify, Bitcoin's value is being closely watched by market analysts who see the cryptocurrency as a potential bellwether for investor confidence and risk appetite. The current sell-off underscores the ongoing volatility that continues to characterize the digital asset landscape.

Cryptocurrency Market Trembles: Bitcoin's Dramatic Descent Amid Global Economic Uncertainty

In the volatile world of digital currencies, investors find themselves navigating treacherous financial waters as Bitcoin experiences a significant downturn, reflecting broader market anxieties and geopolitical tensions that are reshaping investment strategies across global markets.Brace Yourself: Cryptocurrency Investors Face Unprecedented Market Challenges

The Unfolding Economic Landscape

The cryptocurrency ecosystem is experiencing unprecedented turbulence, with Bitcoin confronting a perfect storm of economic challenges. Global market dynamics are creating a complex environment where traditional investment paradigms are being fundamentally challenged. Institutional investors and individual traders alike are witnessing a remarkable transformation in digital asset valuations, driven by intricate macroeconomic factors that extend far beyond simple market speculation. Geopolitical tensions are playing a critical role in shaping investor sentiment. Trade uncertainties, potential tariff implementations, and broader economic policy shifts are creating significant volatility in financial markets. These external pressures are compelling investors to reassess their risk tolerance and portfolio allocations, with cryptocurrency markets bearing the brunt of this recalibration.Bitcoin's Vulnerability in Uncertain Markets

Bitcoin's current trajectory reveals profound vulnerabilities inherent in digital asset investments. The cryptocurrency's value is demonstrating heightened sensitivity to global economic indicators, challenging the narrative of digital currencies as a stable alternative investment vehicle. Sophisticated investors are closely monitoring multiple economic signals that could potentially trigger further market corrections. The interconnected nature of global financial systems means that Bitcoin's performance is no longer isolated from traditional market mechanisms. Emerging regulatory frameworks, institutional investment strategies, and macroeconomic trends are converging to create a complex ecosystem where digital assets must prove their resilience and long-term viability.Risk Management Strategies for Cryptocurrency Investors

Navigating the current market landscape requires sophisticated risk management approaches. Investors must develop nuanced strategies that account for unprecedented market volatility. Diversification, careful asset allocation, and continuous market analysis have become essential tools for maintaining financial stability in an increasingly unpredictable investment environment. Advanced risk mitigation techniques involve comprehensive monitoring of global economic indicators, understanding complex market correlations, and maintaining flexibility in investment approaches. Successful investors are those who can adapt quickly to changing market conditions while maintaining a strategic long-term perspective.Technological and Regulatory Implications

The current market downturn is not merely a financial phenomenon but also a reflection of deeper technological and regulatory developments. Blockchain technologies continue to evolve, with increasing scrutiny from global regulatory bodies reshaping the cryptocurrency landscape. These technological and regulatory dynamics are creating a more mature, sophisticated digital asset ecosystem. Institutional adoption of cryptocurrency technologies continues to progress, albeit with increased caution. Financial institutions are developing more robust frameworks for integrating digital assets into traditional investment portfolios, signaling a potential long-term transformation of global financial systems.Future Outlook and Market Predictions

While current market conditions suggest significant challenges, the cryptocurrency ecosystem remains dynamic and potentially transformative. Sophisticated investors are viewing current market fluctuations as opportunities for strategic positioning. The ability to understand complex market signals and maintain a forward-looking perspective will be crucial in navigating the evolving digital asset landscape. Emerging technologies, changing regulatory environments, and shifting global economic paradigms will continue to reshape cryptocurrency markets. Investors who can effectively interpret these complex interactions will be best positioned to capitalize on future opportunities in this rapidly evolving financial frontier.RELATED NEWS

Cryptocurrency

Crypto Crackdown: North Dakota Moves to Tighten Regulations on Digital Currency Machines

2025-02-20 14:38:06

Cryptocurrency

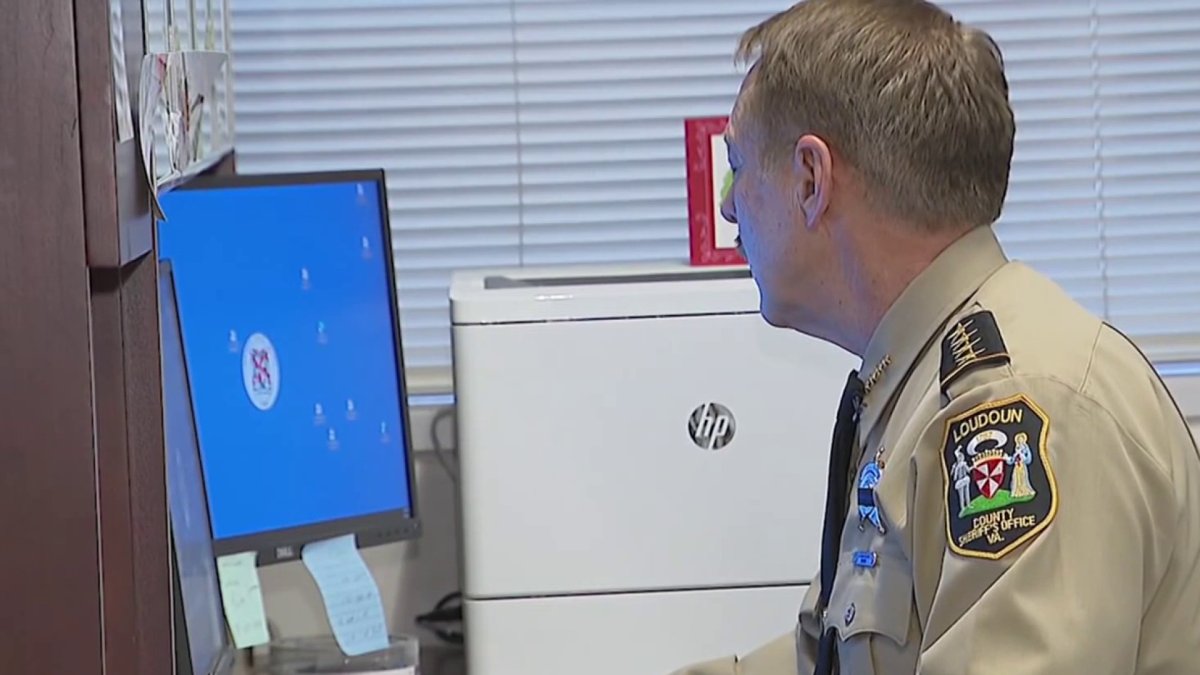

Crypto Heist Foiled: Loudoun Detectives Crack $1.4 Million Scam Case

2025-02-25 04:53:35

Cryptocurrency

Crypto Rollercoaster: Bitcoin's Dramatic Plunge Erases Trump-Era Gains

2025-02-25 11:22:00