Digital Gold Rush: How Crypto Could Revolutionize Global Finance

Cryptocurrency

2025-03-05 18:04:39Content

In a recent candid interview, fintech visionary Micky Malka shared a profound insight that resonates deeply with economic history: the improvement of monetary systems directly correlates with enhanced quality of life. His perspective highlights the transformative power of financial innovation.

Consider the remarkable evolution of payment technologies. Today, a simple tap on a smartphone using Apple Pay represents a quantum leap from ancient methods like tracking farm credits on clay tablets. This dramatic shift underscores how financial technologies can dramatically simplify and improve everyday transactions.

Malka's observation is more than just a casual statement—it's a testament to human progress. As monetary systems become more sophisticated, efficient, and accessible, they unlock unprecedented opportunities for individuals and communities. From digital wallets to blockchain technologies, each innovation brings us closer to a more connected and economically empowered world.

The journey from clay tablets to digital payments is a powerful reminder that when money becomes smarter, people's lives invariably become easier, more convenient, and ultimately, more prosperous.

The Digital Revolution: How Financial Technology is Transforming Human Experience

In the rapidly evolving landscape of global finance, technological innovations are reshaping our understanding of monetary systems, challenging traditional paradigms, and creating unprecedented opportunities for economic empowerment and personal transformation.Revolutionizing Financial Interactions in the Digital Age

The Evolution of Monetary Systems

Financial technologies have fundamentally altered how humans interact with economic systems. From ancient clay tablet accounting to sophisticated digital payment platforms, the journey of monetary exchange represents a profound narrative of human innovation. Modern fintech solutions like Apple Pay demonstrate the remarkable progression from manual record-keeping to instantaneous, seamless transactions that transcend geographical and institutional boundaries. The transformation goes beyond mere convenience. These technological advancements democratize financial access, enabling individuals from diverse socioeconomic backgrounds to participate in global economic ecosystems with unprecedented ease and efficiency. Complex financial instruments that were once exclusive to elite institutions are now accessible through user-friendly mobile applications.Technological Disruption in Financial Services

The emergence of digital payment platforms represents more than a technological upgrade—it signifies a fundamental restructuring of economic interactions. Entrepreneurs like Micky Malka have recognized that improved monetary systems directly correlate with enhanced quality of life. This perspective challenges traditional economic models by emphasizing technological innovation as a catalyst for social and economic mobility. Fintech platforms are dismantling historical barriers to financial participation. Blockchain technologies, cryptocurrency, and decentralized finance (DeFi) platforms are creating new paradigms of economic engagement, allowing individuals to transcend traditional banking limitations and create more flexible, personalized financial strategies.Human-Centric Financial Innovation

The most profound technological developments prioritize human experience. Modern financial technologies are designed with user-centric interfaces that simplify complex economic processes. Machine learning algorithms and artificial intelligence now provide personalized financial recommendations, transforming how individuals understand and manage their economic resources. These innovations extend beyond transactional efficiency. They represent a philosophical shift towards viewing financial systems as tools for personal empowerment rather than restrictive institutional frameworks. By democratizing access to financial information and services, technology is creating more transparent, inclusive economic environments.Global Economic Transformation

Digital financial technologies are rewriting the rules of economic engagement on a global scale. Mobile banking platforms enable entrepreneurs in developing regions to access capital, track investments, and participate in international markets with unprecedented ease. This technological democratization challenges traditional economic hierarchies and creates new pathways for economic development. The convergence of artificial intelligence, blockchain, and mobile technologies is generating innovative financial ecosystems that transcend traditional geographical and institutional boundaries. These platforms are not just changing how we transact—they are fundamentally reimagining the relationship between individuals, technology, and economic opportunity.Future Perspectives in Financial Technology

As technological capabilities continue to expand, the future of financial systems appears increasingly dynamic and personalized. Emerging technologies like quantum computing and advanced machine learning promise even more sophisticated financial tools that can adapt in real-time to individual economic needs and global market conditions. The ongoing digital revolution in finance represents more than a technological trend—it is a fundamental reimagining of economic interaction, promising greater accessibility, transparency, and human-centric design in our monetary systems.RELATED NEWS

Cryptocurrency

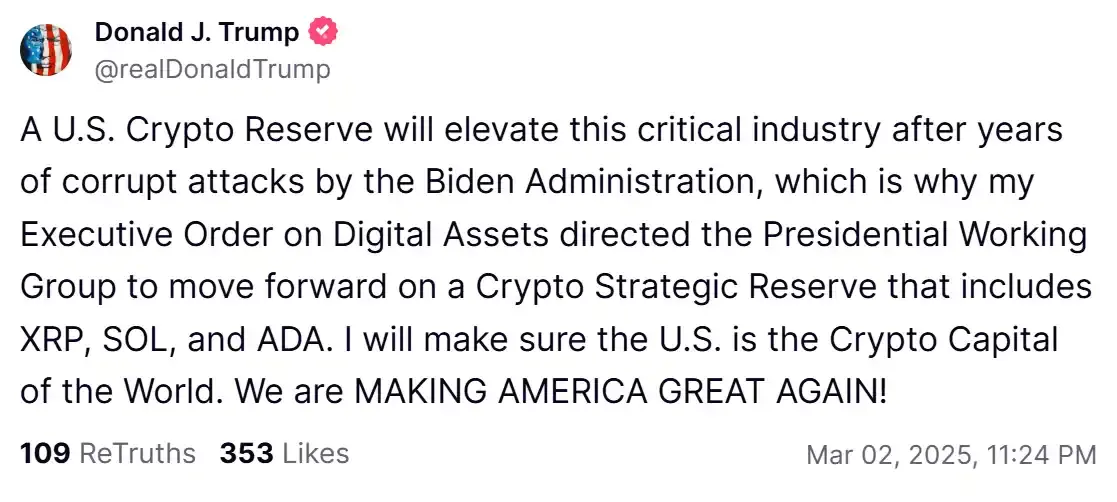

Breaking: Trump Mobilizes Presidential Task Force to Strategize Crypto Reserves, Spotlights XRP, SOL, and ADA

2025-03-02 14:31:00

Cryptocurrency

Digital Paradise Unleashed: PADO Token Lands on LBank, Sparking Crypto Trader Excitement

2025-02-23 12:00:00

Cryptocurrency

Bitcoin Bombshell: Trump's Executive Order Sparks Crypto Controversy

2025-03-07 18:26:07