Political Storm Brewing: Argentina's Milei Faces Potential Impeachment in Cryptocurrency Controversy

Cryptocurrency

2025-02-16 03:59:18Content

Cryptocurrency Controversy Rocks Argentina: President Milei Faces Backlash After Token's Dramatic Collapse

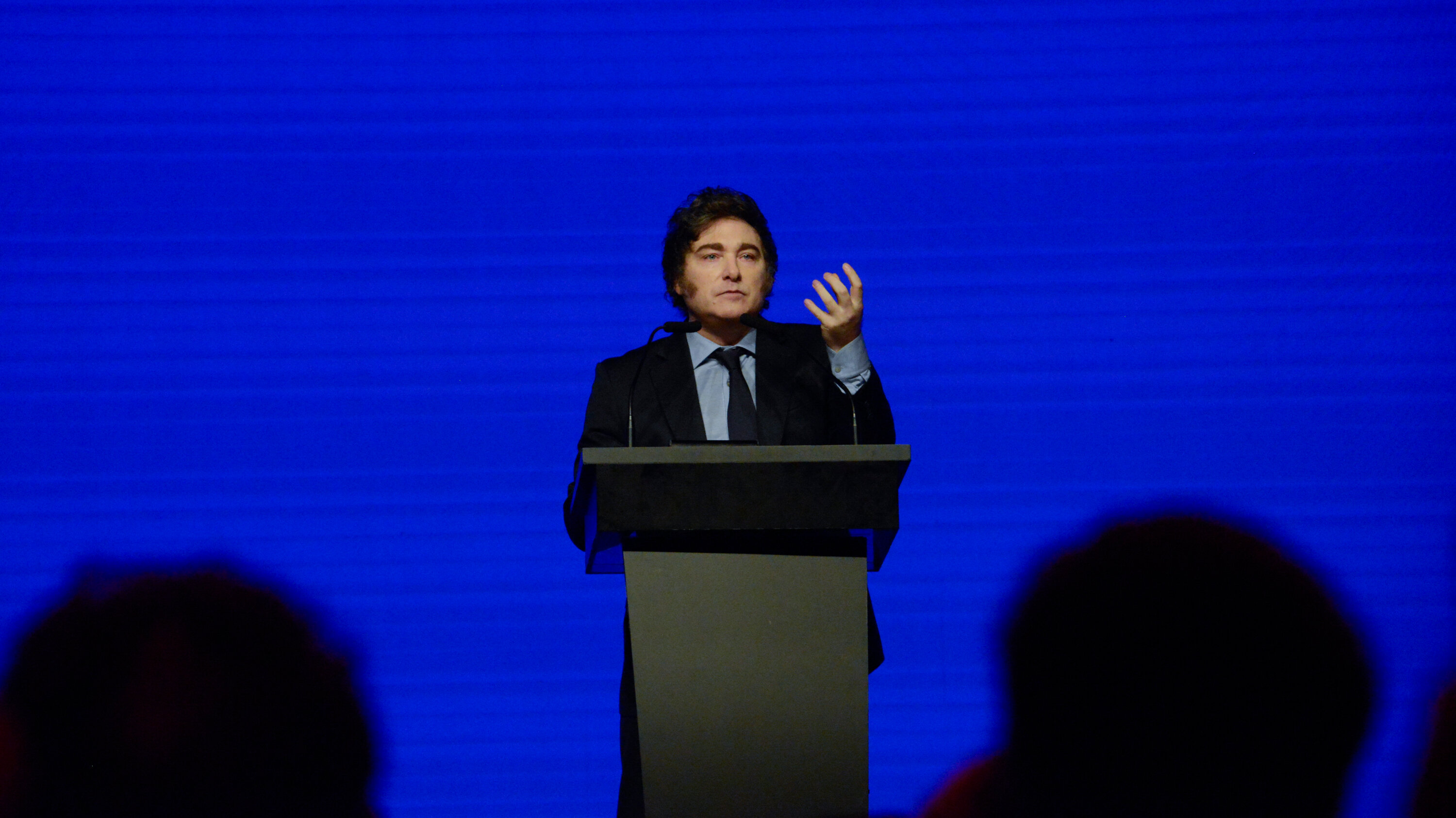

Argentine President Javier Milei is facing intense criticism after a cryptocurrency he publicly promoted on social media experienced a catastrophic market meltdown, leaving investors with substantial financial losses. The incident has raised serious questions about the president's judgment and his involvement in the volatile digital currency landscape.

Milei, known for his libertarian economic views and vocal support of cryptocurrency, had previously championed the token as a potential investment opportunity. However, the sudden and dramatic crash has turned what seemed like a promising endorsement into a potential political and financial liability.

Investors who followed the president's recommendation have been left reeling, with many experiencing significant financial setbacks. The cryptocurrency's precipitous decline has not only damaged individual portfolios but has also cast a shadow over Milei's credibility in financial matters.

This episode highlights the inherent risks of cryptocurrency investments and the potential dangers of high-profile political figures making speculative financial recommendations. As scrutiny intensifies, many are calling for greater accountability and more responsible communication from public officials about investment opportunities.

Crypto Chaos: Milei's Social Media Endorsement Triggers Massive Token Meltdown

In the volatile world of cryptocurrency, where fortunes can be made and lost in the blink of an eye, Argentina's President Javier Milei finds himself at the center of a financial storm that has sent shockwaves through the digital asset landscape. What began as a seemingly innocuous social media endorsement has spiraled into a cautionary tale of market manipulation, investor trust, and the unpredictable nature of emerging digital currencies.When Presidential Influence Meets Crypto Volatility: A High-Stakes Financial Drama

The Unexpected Market Implosion

The cryptocurrency market witnessed an unprecedented event when a token endorsed by President Javier Milei experienced a catastrophic collapse, plummeting by an staggering 85% in value. This dramatic downturn has exposed the fragile ecosystem of digital assets and the potential risks associated with high-profile endorsements. Investors who had placed their trust in the token found themselves facing substantial financial losses, raising critical questions about the responsibility of public figures in the cryptocurrency space. Insider trading allegations quickly emerged, with reports suggesting that key stakeholders strategically cashed out millions before the token's dramatic nosedive. The incident has sparked intense debate about transparency, market manipulation, and the ethical boundaries of cryptocurrency promotion by political leaders.Presidential Influence and Market Dynamics

Javier Milei's involvement in the cryptocurrency market represents a complex intersection of political power and financial innovation. As a leader known for his unconventional economic approaches, his social media endorsement carried significant weight among investors and cryptocurrency enthusiasts. The token's subsequent collapse has highlighted the delicate balance between political influence and market credibility. Experts are now scrutinizing the broader implications of such endorsements, questioning the potential long-term consequences for both the cryptocurrency market and political reputation. The incident serves as a stark reminder of the volatile and unpredictable nature of digital assets, where a single statement can trigger massive market fluctuations.Regulatory Implications and Investor Protection

The token's dramatic crash has reignited discussions about cryptocurrency regulation and investor protection. Financial watchdogs are likely to intensify their scrutiny of social media endorsements and their potential to manipulate market sentiments. The incident underscores the need for robust regulatory frameworks that can mitigate risks and protect investors from potentially predatory market practices. Cryptocurrency experts argue that this event demonstrates the critical importance of due diligence and independent research. Investors are being urged to look beyond celebrity endorsements and carefully evaluate the fundamental value and technological underpinnings of digital assets before committing their financial resources.The Psychological Impact on Crypto Investors

Beyond the financial ramifications, the token's collapse has profound psychological implications for the cryptocurrency community. Trust, a fundamental currency in the digital asset ecosystem, has been significantly eroded. Investors are left questioning the credibility of endorsements and the potential motivations behind high-profile promotions. The incident serves as a powerful reminder of the inherent risks in the cryptocurrency market, where speculation, sentiment, and external influences can dramatically reshape investment landscapes in mere moments. It highlights the need for a more mature, transparent, and responsible approach to digital asset promotion and investment.RELATED NEWS

Cryptocurrency

Crypto Chaos: How Trump's Cabinet Shakeup Sent Bitcoin Markets Reeling

2025-02-26 19:11:46