Crypto Meets Capitol: State Treasurer's Bold Investment Frontier Unlocked

Cryptocurrency

2025-03-09 19:01:00

In a groundbreaking move, the House Commerce Committee has overwhelmingly endorsed House Bill 302, signaling a potential shift in how public funds are managed. The proposed legislation would grant the State Treasurer unprecedented flexibility by allowing investment of up to 5% of total public funds into digital assets. This landmark decision reflects a growing recognition of digital currencies and blockchain technologies as legitimate investment vehicles. By opening the door to digital asset investments, the committee is positioning the state at the forefront of financial innovation and demonstrating a forward-thinking approach to public fund management. The near-unanimous vote underscores a bipartisan acknowledgment of the evolving financial landscape and the potential opportunities presented by digital assets. If passed, this bill could set a precedent for other states considering similar investment strategies. MORE...

Crypto Meets Capitol: State Treasurer's Bold Investment Frontier Unlocked

Cryptocurrency

2025-03-09 19:01:00

In a groundbreaking move, the House Commerce Committee has overwhelmingly endorsed House Bill 302, signaling a potential shift in how public funds are managed. The proposed legislation would grant the State Treasurer unprecedented flexibility by allowing investment of up to 5% of total public funds into digital assets. This landmark decision reflects a growing recognition of digital currencies and blockchain technologies as legitimate investment vehicles. By opening the door to digital asset investments, the committee is positioning the state at the forefront of financial innovation and demonstrating a forward-thinking approach to public fund management. The near-unanimous vote underscores a bipartisan acknowledgment of the evolving financial landscape and the potential opportunities presented by digital assets. If passed, this bill could set a precedent for other states considering similar investment strategies. MORE...

Crypto Meets Capitol: State Treasurer's Bold Investment Frontier Unlocked

Cryptocurrency

2025-03-09 19:01:00

In a groundbreaking move, the House Commerce Committee has overwhelmingly endorsed House Bill 302, signaling a potential shift in how public funds are managed. The proposed legislation would grant the State Treasurer unprecedented flexibility by allowing investment of up to 5% of total public funds into digital assets. This landmark decision reflects a growing recognition of digital currencies and blockchain technologies as legitimate investment vehicles. By opening the door to digital asset investments, the committee is positioning the state at the forefront of financial innovation and demonstrating a forward-thinking approach to public fund management. The near-unanimous vote underscores a bipartisan acknowledgment of the evolving financial landscape and the potential opportunities presented by digital assets. If passed, this bill could set a precedent for other states considering similar investment strategies. MORE...

Bitcoin ETF Showdown: IBIT and FBTC Battle for Investor Supremacy

Cryptocurrency

2025-03-09 19:00:00

IBIT vs FBTC: A Comprehensive Showdown of Bitcoin ETFs

Investors looking to dive into the world of Bitcoin without directly managing cryptocurrency wallets now have compelling exchange-traded fund (ETF) options. Two standout contenders in this space are the iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC). Let's break down these investment vehicles to help you make an informed decision.

Holdings and Structure

Both IBIT and FBTC are designed to track the price of Bitcoin, offering investors a straightforward way to gain cryptocurrency exposure through traditional investment channels. They hold actual Bitcoin as their primary asset, providing a direct link to the cryptocurrency's market performance.

Performance Comparison

While both ETFs are relatively new to the market, they've shown promising potential. IBIT, backed by BlackRock, and FBTC, supported by Fidelity, have demonstrated similar tracking capabilities to Bitcoin's price movements. Investors should note that past performance doesn't guarantee future results, but both funds offer a regulated and transparent approach to Bitcoin investment.

Key Considerations

- Expense Ratio: Compare the management fees carefully

- Liquidity: Assess trading volumes and market accessibility

- Tracking Accuracy: Evaluate how closely each fund mirrors Bitcoin's price

Risk Factors

Bitcoin remains a volatile asset, and these ETFs are not immune to significant price fluctuations. Potential investors should:

- Understand the high-risk nature of cryptocurrency investments

- Consider their personal risk tolerance

- Diversify their overall investment portfolio

Final Verdict

Both IBIT and FBTC offer compelling ways to invest in Bitcoin. Your choice may depend on specific factors like expense ratios, trading platforms, and personal investment preferences. Consulting with a financial advisor can help you make the most informed decision tailored to your investment goals.

Disclaimer: Cryptocurrency investments carry significant risk. Always conduct thorough research and consider your financial situation before investing.

MORE...Bitcoin ETF Showdown: IBIT and FBTC Battle for Investor Supremacy

Cryptocurrency

2025-03-09 19:00:00

IBIT vs FBTC: A Comprehensive Showdown of Bitcoin ETFs

Investors looking to dive into the world of Bitcoin without directly managing cryptocurrency wallets now have compelling exchange-traded fund (ETF) options. Two standout contenders in this space are the iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC). Let's break down these investment vehicles to help you make an informed decision.

Holdings and Structure

Both IBIT and FBTC are designed to track the price of Bitcoin, offering investors a straightforward way to gain cryptocurrency exposure through traditional investment channels. They hold actual Bitcoin as their primary asset, providing a direct link to the cryptocurrency's market performance.

Performance Comparison

While both ETFs are relatively new to the market, they've shown promising potential. IBIT, backed by BlackRock, and FBTC, supported by Fidelity, have demonstrated similar tracking capabilities to Bitcoin's price movements. Investors should note that past performance doesn't guarantee future results, but both funds offer a regulated and transparent approach to Bitcoin investment.

Key Considerations

- Expense Ratio: Compare the management fees carefully

- Liquidity: Assess trading volumes and market accessibility

- Tracking Accuracy: Evaluate how closely each fund mirrors Bitcoin's price

Risk Factors

Bitcoin remains a volatile asset, and these ETFs are not immune to significant price fluctuations. Potential investors should:

- Understand the high-risk nature of cryptocurrency investments

- Consider their personal risk tolerance

- Diversify their overall investment portfolio

Final Verdict

Both IBIT and FBTC offer compelling ways to invest in Bitcoin. Your choice may depend on specific factors like expense ratios, trading platforms, and personal investment preferences. Consulting with a financial advisor can help you make the most informed decision tailored to your investment goals.

Disclaimer: Cryptocurrency investments carry significant risk. Always conduct thorough research and consider your financial situation before investing.

MORE...Bitcoin ETF Showdown: IBIT and FBTC Battle for Investor Supremacy

Cryptocurrency

2025-03-09 19:00:00

IBIT vs FBTC: A Comprehensive Showdown of Bitcoin ETFs

Investors looking to dive into the world of Bitcoin without directly managing cryptocurrency wallets now have compelling exchange-traded fund (ETF) options. Two standout contenders in this space are the iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC). Let's break down these investment vehicles to help you make an informed decision.

Holdings and Structure

Both IBIT and FBTC are designed to track the price of Bitcoin, offering investors a straightforward way to gain cryptocurrency exposure through traditional investment channels. They hold actual Bitcoin as their primary asset, providing a direct link to the cryptocurrency's market performance.

Performance Comparison

While both ETFs are relatively new to the market, they've shown promising potential. IBIT, backed by BlackRock, and FBTC, supported by Fidelity, have demonstrated similar tracking capabilities to Bitcoin's price movements. Investors should note that past performance doesn't guarantee future results, but both funds offer a regulated and transparent approach to Bitcoin investment.

Key Considerations

- Expense Ratio: Compare the management fees carefully

- Liquidity: Assess trading volumes and market accessibility

- Tracking Accuracy: Evaluate how closely each fund mirrors Bitcoin's price

Risk Factors

Bitcoin remains a volatile asset, and these ETFs are not immune to significant price fluctuations. Potential investors should:

- Understand the high-risk nature of cryptocurrency investments

- Consider their personal risk tolerance

- Diversify their overall investment portfolio

Final Verdict

Both IBIT and FBTC offer compelling ways to invest in Bitcoin. Your choice may depend on specific factors like expense ratios, trading platforms, and personal investment preferences. Consulting with a financial advisor can help you make the most informed decision tailored to your investment goals.

Disclaimer: Cryptocurrency investments carry significant risk. Always conduct thorough research and consider your financial situation before investing.

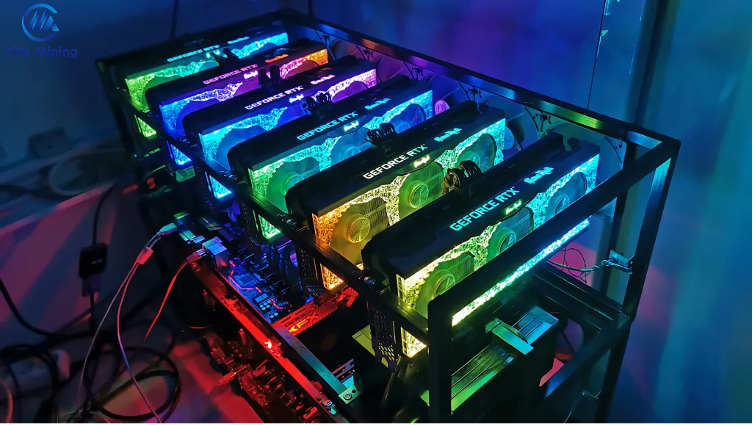

MORE...Crypto Gold Rush: How Cloud Mining is Turning Everyday Investors into Six-Figure Earners

Cryptocurrency

2025-03-09 18:10:31

Cryptocurrency Market Surges: A New Era of Digital Wealth Unfolds The digital financial landscape is experiencing an electrifying transformation as cryptocurrencies like Bitcoin and Ethereum reach unprecedented heights. This remarkable surge is capturing the imagination of investors, technologists, and financial experts worldwide, signaling a potential paradigm shift in how we perceive and interact with money. The current market momentum is unlike anything seen before, with digital currencies breaking through traditional barriers and attracting unprecedented levels of mainstream attention. Investors are increasingly viewing cryptocurrencies not just as speculative assets, but as legitimate investment vehicles with substantial growth potential. Bitcoin and Ethereum, the two most prominent cryptocurrencies, are leading this financial revolution, demonstrating remarkable resilience and attracting both institutional and individual investors. Their rising valuations reflect growing confidence in blockchain technology and the decentralized financial ecosystem. As more people recognize the transformative potential of cryptocurrencies, the market continues to expand, promising exciting opportunities for those willing to explore this dynamic new frontier of digital finance. The ongoing boom suggests we are witnessing the early stages of a profound economic revolution. MORE...

Crypto Gold Rush: How Cloud Mining is Turning Everyday Investors into Six-Figure Earners

Cryptocurrency

2025-03-09 18:10:31

Cryptocurrency Market Surges: A New Era of Digital Wealth Unfolds The digital financial landscape is experiencing an electrifying transformation as cryptocurrencies like Bitcoin and Ethereum reach unprecedented heights. This remarkable surge is capturing the imagination of investors, technologists, and financial experts worldwide, signaling a potential paradigm shift in how we perceive and interact with money. The current market momentum is unlike anything seen before, with digital currencies breaking through traditional barriers and attracting unprecedented levels of mainstream attention. Investors are increasingly viewing cryptocurrencies not just as speculative assets, but as legitimate investment vehicles with substantial growth potential. Bitcoin and Ethereum, the two most prominent cryptocurrencies, are leading this financial revolution, demonstrating remarkable resilience and attracting both institutional and individual investors. Their rising valuations reflect growing confidence in blockchain technology and the decentralized financial ecosystem. As more people recognize the transformative potential of cryptocurrencies, the market continues to expand, promising exciting opportunities for those willing to explore this dynamic new frontier of digital finance. The ongoing boom suggests we are witnessing the early stages of a profound economic revolution. MORE...

Ethereum's Delicate Balance: One Critical Level Stands Between Stability and Market Chaos

Cryptocurrency

2025-03-09 15:00:47

In the volatile world of cryptocurrency, Ethereum has been wrestling with a persistent challenge: breaking free from its current price ceiling. The digital asset, which ranks second in market capitalization, has found itself in a prolonged holding pattern, unable to surge past critical resistance levels throughout the past year. Despite numerous strategic attempts and market rallies, Ethereum has repeatedly fallen short of achieving a significant breakthrough. Technical analysts and investors have watched closely as the cryptocurrency repeatedly approaches key price thresholds, only to retreat and consolidate at lower levels. The sustained sideways movement has created a sense of anticipation and uncertainty in the crypto market. Traders and blockchain enthusiasts are eagerly awaiting a potential catalyst that could propel Ethereum beyond its current technical barriers and signal a new phase of growth and momentum. As the cryptocurrency landscape continues to evolve, Ethereum's current price dynamics underscore the complex and unpredictable nature of digital asset markets. Investors remain hopeful that the next market shift could finally unlock the potential for a substantial price movement. MORE...

Ethereum's Delicate Balance: One Critical Level Stands Between Stability and Market Chaos

Cryptocurrency

2025-03-09 15:00:47

In the volatile world of cryptocurrency, Ethereum has been wrestling with a persistent challenge: breaking free from its current price ceiling. The digital asset, which ranks second in market capitalization, has found itself in a prolonged holding pattern, unable to surge past critical resistance levels throughout the past year. Despite numerous strategic attempts and market rallies, Ethereum has repeatedly fallen short of achieving a significant breakthrough. Technical analysts and investors have watched closely as the cryptocurrency repeatedly approaches key price thresholds, only to retreat and consolidate at lower levels. The sustained sideways movement has created a sense of anticipation and uncertainty in the crypto market. Traders and blockchain enthusiasts are eagerly awaiting a potential catalyst that could propel Ethereum beyond its current technical barriers and signal a new phase of growth and momentum. As the cryptocurrency landscape continues to evolve, Ethereum's current price dynamics underscore the complex and unpredictable nature of digital asset markets. Investors remain hopeful that the next market shift could finally unlock the potential for a substantial price movement. MORE...